The rise of electric vehicles has made investing in automotive stocks and shares a popular move for many investors. Today, firms in this stock market sector are investing in futuristic innovations which offer potentially enormous long-term opportunities.

According to Global Electric Vehicle Market, this segment of the auto industry is expected to reach 34.8 million units by 2030. But it’s not the only innovation in town. The automotive sector is also being dominated by automation. Features like automatic braking, parking, driving, and lane-keeping assistance are becoming increasingly common, even in low-end vehicles.

With that in mind, let’s explore automotive shares in more detail. How do these businesses work? What is the growth potential? And where are the risks?

What are Automotive Stocks?

The automotive sector includes companies that manufacture passenger cars, SUVs, minivans, trucks, and motorcycles. They usually target the end consumer instead of commercial businesses. However, there are some business-facing parts of these firms. For example, most automotive stocks offer their vehicles in fleets to other business clients who provide work vehicles for employees.

Not all automotive shares are manufacturers of vehicles, though. There are actually three types of companies that fall under this designation:

- Auto Manufacturers – This includes all the automotive stocks which are involved in the manufacturing of cars, trucks and even EV stocks.

- Auto Part Supplier – This includes firms involved in the production and distribution of parts like brakes, clutches, air filters, and oil filters.

- Auto Dealers & Retailers – New and used vehicles are sold at retail through car dealerships. All such companies fall under this category of automotive stocks.

The Risks and Challenges Faced by Automotive Shares

There is no denying the fact that every sector faces challenges. But preparing to accept the challenge and manoeuvring the operations accordingly is the key to winning the race. Succeeding in this industry is pretty tough. And there are countless examples of car companies that have tried and failed. Let’s take a look at some of the factors that I think could signal a red flag when thinking about investing in automotive shares.

- Increased Number of Projects – To stay competitive, automotive companies are taking on an increased number of projects in the coming future. But it’s important to check that these firms haven’t bitten off more than they can chew. Suppose a group cannot fulfil its expanding order book. In that case, it could result in reputational damage and create opportunities for competitors.

- Reduce Product Development time – The need to deliver fast has become a necessity amongst all automotive stocks. Therefore, the automotive shares need to change their approach toward hardware development for efficient production.

- Low Vehicle Sales – It’s important to note that the pandemic brought one of the critical challenges for automotive stocks. Vehicle purchases were the least priority of consumers when lockdowns prevented them from going anywhere. Hence, low vehicle sales led to excess inventory, high levels of debt, and uncertain demand.

- Diminishing Customer Loyalty – A recent study by S&P Global revealed a correlation between a day’s supply of cars and customer loyalty. Customers are extremely likely to switch dealers or even brands in order to purchase a vehicle of their choice at a good price.

- Digital Marketing & Online Dealing – Online buying and selling of vehicles has increased drastically over the years, courtesy of platforms like Auto Trader. On the contrary, most customers are not satisfied with the current service of online dealing. Therefore, managing the changed customer purchase preference is becoming a challenge for automotive stocks.

Key Financial Metrics to Consider Before Investing in Automotive Stocks

Financial statements can reveal a lot of qualities and problems of any business. But knowing how to read these tables and use the right metrics is a different story. Every industry is different. And therefore requires a different analytical approach.

For automotive stocks and shares, I’ve found that the following metrics are vital to check when thinking about investing in this sector:

- Debt-to-Equity – Because of the capital-intensive nature of business, automotive stocks have to be able to keep their leverage in check. This ratio tells the company’s ability to meet its financial obligations and how well money is being managed within the business.

- Inventory Turnover – Inventory Turnover is an excellent metric to analyse the current selling situation of automotive stocks. It reveals how often a business has sold and replaced its inventory. Too low, and that suggests there is little demand for its vehicles. Too high, and that suggests the company is likely underpricing its vehicles.

- Return-on-Equity (ROE) – ROE is one of the most important ratios that investors consider before investing in automotive stocks. As this ratio indicates the potential future return, the shareholders can earn.

- EBITDA – EBITDA is a useful metric for measuring an automotive stock’s underlying cash flow.

- Average Downtime – If the average downtime of its facilities is high, that’s typically a sign of trouble within its manufacturing division. Simply put, the longer the downtime, the fewer vehicles the firm can produce.

- Utilisation Rate – This ratio indicates how many vehicles an automotive group can produce over some time. Also, it tells how many vehicles the company could potentially produce in that same period with optimal use of time and labour.

- Throughput – Throughput is a measure of the average number of units being produced over a time period. It is considered one of the most important metrics for measuring the effectiveness of a production line.

Key Terms to Know Before Investing in Automotive Stocks

This industry is far from the most complicated out there. But there is still a bit of jargon that Automotive shares use in their reports. Let’s take a look at some common examples and explain what they mean.:

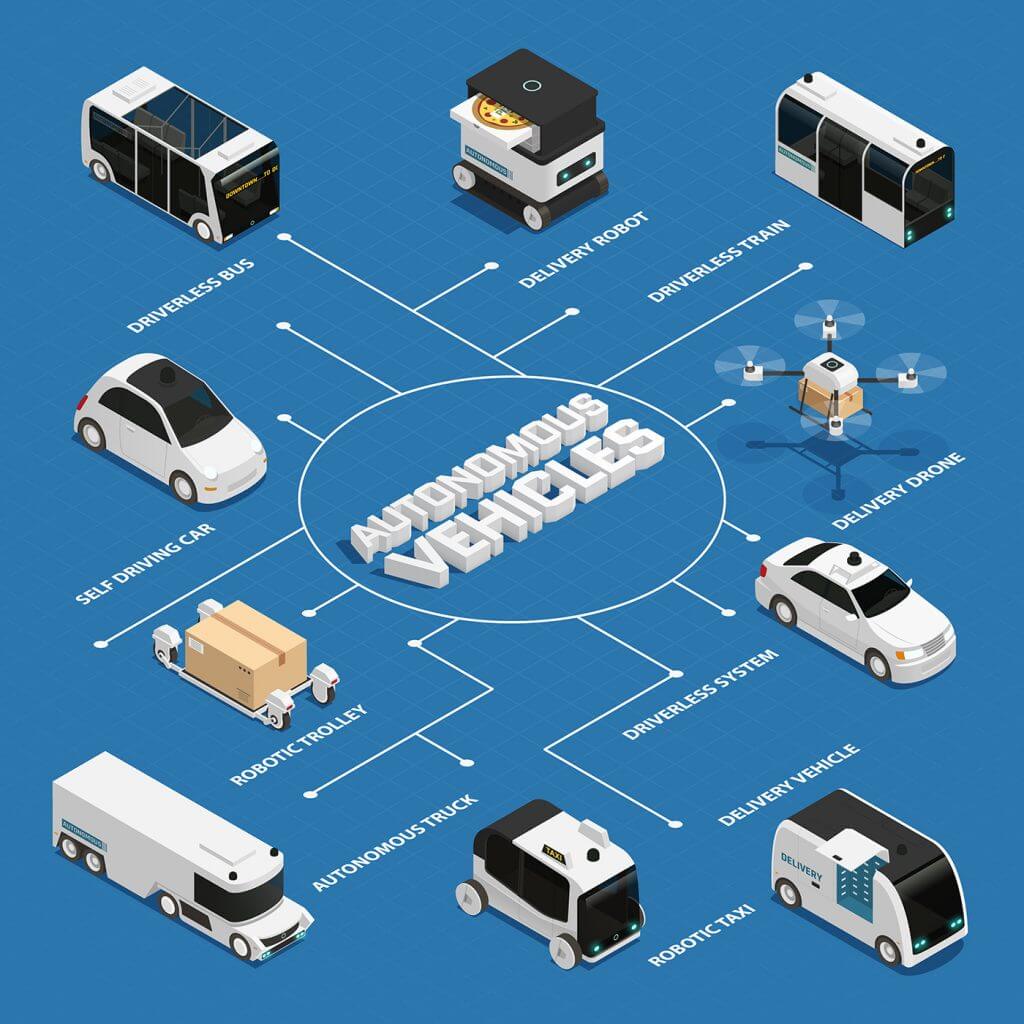

- Autonomous Vehicles – Vehicles that can drive themselves.

- ABS – Antilock braking system.

- ADAS – Advanced Driver Assistance system. This technology enables the car to detect nearby objects and alert the driver.

- Telematics – This is a method of monitoring the vehicle through GPS and onboard diagnostics.

- Hybrid Electric Vehicles – These vehicles generate power from both electricity and petrol/diesel.

- Plug-in Hybrid Electric Vehicle – These vehicles generate power from both petrol and electricity. Additionally, they have a plug-in option for external charging.

Market size and Forecasted Growth of the Automotive Industry

According to a 2021 report by Research And Markets, the global automotive industry consists of 85.32 million units. By 2030 that figure is expected to reach 122.83 million delivering an average annualised compounded growth rate of 3.71%.

This certainly doesn’t sound like the most exciting growth opportunity. But looking closer at some of the sub-sectors within this industry reveals some more promising trends. Electric vehicle stocks, for example, have a rapidly expanding market opportunity of 24.3% on an annualised basis. Meanwhile, a further 58 million new self-driving vehicles are expected to hit the road by 2030

Some trends to watch out for within this industry moving forward are:

- Adoption of electric vehicles

- Autonomous vehicles will become more popular

- With 5G technology and the Internet of Things (IoT), vehicles will become more connected

- Increased online purchase of cars

Top Automotive Stocks in the UK by Market Capitalisation

| Company | Market Cap. | Category | Description |

|---|---|---|---|

| Rolls-Royce (LSE:RR) | £7.42bn | Auto Manufacturers | The company designs, manufactures, and sells luxury vehicles worldwide. |

| Auto Trader Group (LSE:AUTO) | £5.53bn | Auto Dealers & Retailers | Owns and operates an online platform that enables individuals and businesses to buy and sell vehicles through its website. |

| Aston Martin Lagoda (LSE:AML) | £824.5m | Auto Manufacturers | Aston Martin Lagonda Global Holdings designs, develops, manufactures, markets, and sells luxury sports cars under the Aston Martin and Lagonda brand names worldwide. |

| Halfords Group (LSE:HFD) | £489.5m | Auto Part Supplier | One of the largest auto part retailers in the UK that also offers MOT and vehicle services. |

| Lookers (LSE:LOOK) | £284.8m | Auto Dealers & Retailers | British car dealership chain sells new and used cars directly to consumers. |

Top Automotive Stocks in the US by Market Capitalisation

| Company | Market Cap. | Category | Description |

|---|---|---|---|

| Tesla (NASDAQ:TSLA) | $812.3bn | Auto Manufacturers | Tesla, Inc. designs, develops, manufactures, leases, and sells electric vehicles and energy generation and storage systems in the United States, China, and internationally. |

| General Motors (NYSE:GM) | $57bn | Auto Manufacturers | General Motors Company designs, builds and sells trucks, crossovers, cars, and automobile parts and accessories in North America, the Asia Pacific, the Middle East, Africa, South America, the United States, and China |

| Ford (NYSE:F) | $54.7bn | Auto Manufacturers | Ford Motor Company designs, manufactures, markets, and services a range of Ford trucks, cars, sport utility vehicles, electrified vehicles, and Lincoln luxury vehicles worldwide. It operates through three segments: Automotive, Mobility, and Ford Credit. |

| Lucid Motors (NASDAQ:LCID) | $33.1bn | Auto Manufacturers | Lucid Group, Inc. a technology and automotive company, develops electric vehicle (EV) technologies. The company designs, engineers, and builds electric vehicles, EV powertrains, and battery systems. |

| Rivian (NASDAQ:RIVN) | $28.3bn | Auto Manufacturers | Rivian Automotive, Inc. designs, develops, manufactures, and sells electric vehicles and accessories. The company offers five-passenger pickup trucks and sports utility vehicles. |

Should I Invest in Automotive Shares?

The automotive industry has been undergoing unprecedented changes since early 2020. First, the industry was hit pretty badly because of the pandemic. And now, the post-Covid period has brought major transitions within the automotive stocks.

Investing in automotive stocks is currently a hot debate within the investor world. Because, as an investor, the decision between which automotive share to invest in will eventually decide the fate of my portfolio. Personally, I believe all those companies which are following the current trends are one the best automotive stocks to invest in – providing, of course, they have a reasonable strategy and solid financials to match.

There are a lot of risks to consider, which means this industry is certainly not for everyone. But since I’m comfortable taking some risks for my portfolio, I see auto stocks as excellent investment candidates.

Discover market-beating stock ideas today. Join our Premium investing service to get instant access to analyst opinions, in-depth research, our Moonshot Opportunities, and more. Learn More

Saima Naveed does not own shares in any of the companies mentioned. The Money Cog has published a Premium Report on Tesla Inc, and Auto Trader Group. The Money Cog has no position in any of the companies mentioned. Views expressed on the companies and assets mentioned in this article are those of the writer and therefore may differ from the opinions of analysts in The Money Cog Premium services.