Electric Vehicle shares or EV stocks have gained popularity and have attracted investors massively in recent times. This is amidst the fact that electric vehicles are expected to replace traditional combustion engines within the next ten years. That certainly sounds like a lucrative investment opportunity. And it’s hardly surprising to see traditional automakers begin to tap into the electric vehicle market.

With that in mind, let’s dive into this stock market sector and discover what these businesses do, who are the leaders, and what the risks are by investing in the EV sector.

What are EV stocks

The electric vehicle ecosystem is largely a connected one. As a result, there exists an interdependence of a lot of factors.

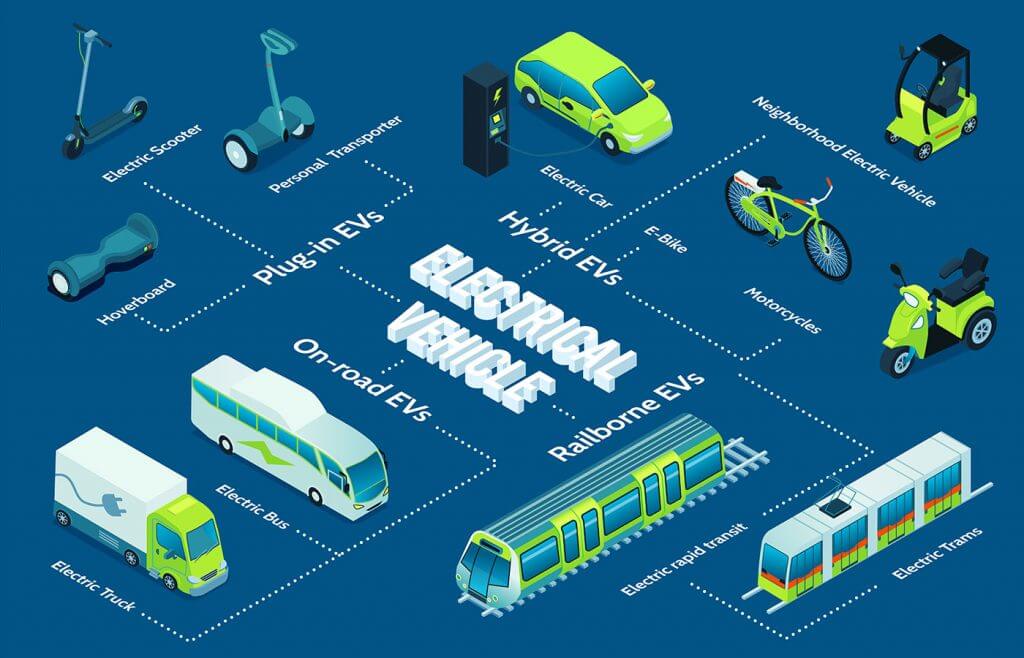

There are different types of stocks within the EV industry.

Firstly, there are companies involved with electric vehicle production. Some of the most well-known businesses in this segment include Tesla, Lucid Motors, and Rivian Automotive. However, some legacy automotive stocks such as General Motors, Ford Motor Company, and Volkswagen have all begun investing heavily in expanding their respective EV portfolios. Therefore, the competition within this part of the electric car ecosystem is heating up.

Another part of the electrification of vehicles that can often be forgotten is the firms in charge of making the EV batteries. While Tesla does this in house, other firms outsource the complex task to other EV stocks. Some of the more well-known battery manufacturing businesses include CATL and LG Energy Solution.

The last category that electric vehicle shares can fall into is EV Infrastructure. This captures all the companies investing in expanding recharging stations across the world, such as ChargePoint, BP, and Shell.

What are the main risks to EV shares?

As exciting as the opportunity seems, investing in EV stocks is not risk-free. I’ve already touched on the surging volume of competition vehicle manufacturers now have to face. But that’s not the end of the list of threats.

With all companies rushing to meet the deadline of the Paris Climate Agreement, production targets are mounting rapidly. Consequently, this is pushing the prices of battery metals and semi-conductors through the roof.

With supply chain restrictions pushing up commodity prices, the operating environment for these businesses is becoming far more capital intensive. This isn’t much of a problem for legacy automakers with established supply lines and manufacturing facilities. But for newer entrants into the space, the hurdles are getting higher.

Key Financial Metrics

Like every smart investor, one should not invest blindly. Being able to measure EV companies’ performance will help make better decisions about which EV stock to buy. That being said, here are some essential metrics I’d keep an eye on.

- Debt-to-Equity – A high value could indicate the firm is being too reliant on debt.

- Inventory Turnover – If the company isn’t clearing inventory, it could suggest demand for its vehicles is low.

- Return on Equity – Is the company actually delivering earnings to shareholders?

- Total Cost of Manufacturing – How does this compare against its competitors?

- Production Volumes – Does the firm have enough capacity to meet its order book?

- Operating Profit Margin – Is the EV business capable of achieving margins higher than competitors?

Key Terms when investing in EV stocks

Electric vehicles are quite different from internal combustion engines. That being said, some terms are peculiar to them.

- All-electric Range (AER) – Refers to the distance a vehicle could travel on electric power.

- Battery Electric Vehicle (BEV) – Refers to an electric car that is powered by an onboard rechargeable lithium ion battery.

- DC Fast Charging (DCFC) – This is also known as Level 3 charging. It is the fastest charging available for EVs.

- Degradation – Refers to the decrease in battery capacity over time.

- Electric Vehicle (EV) – Refers to a vehicle that is powered by electric power through an onboard battery. It could either be a BEV or PHEV.

- Kilowatts (kW) – This is a unit of power. The higher the power, the better the performance of the vehicle.

- Kilowatt-hour (kWh) – The unit of energy refers to the energy capacity of the battery.

- Miles Per Gallon Equivalent (MPGe) – Used to measure how efficient an EV is compared to an internal combustion engine (ICE) vehicle. EVs usually have 90-130 MPGe. The average EV is three times as efficient as an average ICE vehicle. One gallon of gas roughly equals 33.7 kWhs.

- Plug-in Hybrid Electric Vehicle (PHEV) – Refers to an electric car that use both electric and gas to power them.

- Range – Refers to the distance the vehicle can go before needing to recharge.

- Regenerative Braking (Regen) – Helps to convert the wasted energy from the slowing down of a car and using it to recharge the vehicle’s batteries.

- Thermal Management System (TMS) – The system helps to reduce the size of the electric engines as well as improve the power of the battery and ensure its longevity.

What is the market size?

According to a report by the International Energy Agency, electric vehicle sales reached 3 million in 2020 – 4.6% of total vehicle sales that year. This is actually up by around 40% versus 2019. And analyst forecasts indicate this growth is likely to accelerate as adoption ramps up.

In a report by Fortune Business Insights, the EV market size is expected to grow from $287.36bn in 2021 to $1,318.22bn by 2028. That’s a compounded annual growth rate of 24.3% over a seven-year period. Needless to say, that’s quite a massive growth opportunity for EV stocks.

Top EV stocks in the UK by market capitalisation

Below is a table containing the most prominent UK electric car stocks in order of market capitalisation.

| Company | Market Cap. | Category | Description |

|---|---|---|---|

| Shell (LSE:SHEL) | £162.81bn | EV Infrastructure | Operates over 90,000 EV charging points and aims to increase it to 500,000 by 2025. |

| BP (LSE:BP) | £79.40bn | EV Infrastructure | Operates over 8,000 BP pulse points in the UK. |

| Aston Martin Lagonda (LSE:AML) | £988.05m | EV Manufacturer | Plans to launch its first EV in 2025 |

| Pod Point Group Holding (LSE:PODP) | £335.00m | EV Infrastructure | A leader in UK EV charging. |

Top EV stocks in the US by market capitalisation

Below is a table containing the most prominent electric car stocks found in the United States in order of market capitalisation.

| Company | Market Cap. | Category | Description |

|---|---|---|---|

| Tesla Inc (NASDAQ:TSLA) | $935.45bn | EV Manufacturer, Infrastructure, Battery | Based in North America, Elon Musk’s Tesla leads in the production and sale of EVs. The company aims to sell 1.5 million EVs in 2022. |

| Ford Motor Company (NYSE:F) | $57.35bn | EV Manufacturer | Ford launched its Ford F-150 lightning EV recently |

| Lucid Group (NASDAQ:LCID) | $31.78bn | EV Manufacturer | This electric vehicle stock recently launched production of Lucid Air in 2021 |

| Rivian Automotive (NASDAQ:RIVN) | $28.59bn | EV Manufacturer | The EV company started production of R1T Electric Pick up in 2021 |

| Nio Inc (NYSE:NIO) | $28.02bn | EV Manufacturer | Nio 91,429 electric vehicles in 2021 |

Should I Invest in EV shares?

Investing in EV stocks now could enable my portfolio to profit from the upside potential of the sector. With the 2050 Paris Climate Agreement deadline drawing near, the production of EVs is bound to scale up. At least, I think so.

Having said that, the high-risk profile of some of these businesses means best EV stocks are not suitable for everyone. Personally, I feel it’s a risk worth taking. But I intend to take a diversified approach to spread my bets across the entire sector.

Discover market-beating stock ideas today. Join our Premium investing service to get instant access to analyst opinions, in-depth research, our Moonshot Opportunities, and more. Learn More

Prosper Ambaka owns shares in Ford Motor Company. The Money Cog has published a Premium Report on Tesla Inc. The Money Cog has no position in any of the companies mentioned. Views expressed on the companies and assets mentioned in this article are those of the writer and therefore may differ from the opinions of analysts in The Money Cog Premium services.