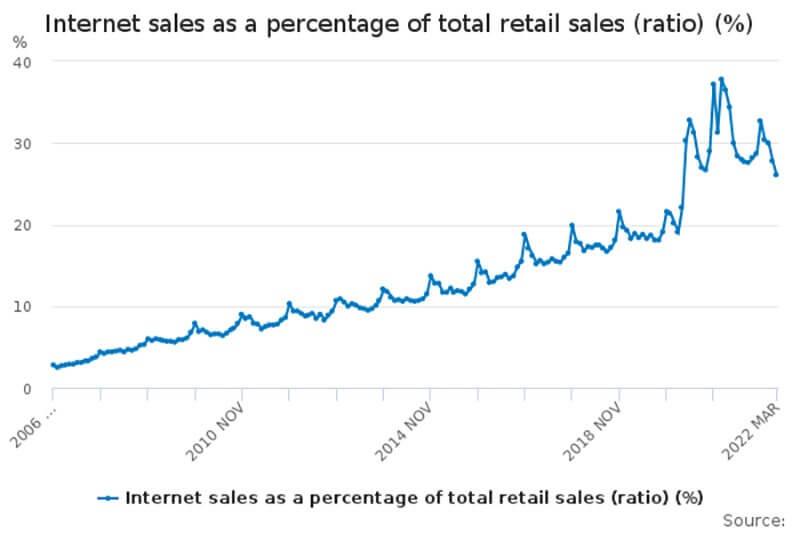

Investing in e-commerce stocks and shares could be very profitable over the next decade. After all, current trends indicate online shopping as a proportion of total retail spending is still rising even with the pandemic no longer keeping brick & mortar stores closed.

While many investors believe the ship has sailed for investing in these online retail businesses, there actually remains an enormous amount of room left for growth. Here in the UK, data from the Office for National Statistics reveals online shopping to be responsible for only a quarter of total retail spending. In other words, the growth seen so far could be just the start.

As exciting as this prospect is, this isn’t a forgone conclusion. And there are plenty of risks to consider before adding e-commerce shares to a portfolio. So, let’s dive into the details and discover the risks and potential of this stock market sector.

What are E-commerce Stocks?

E-commerce stocks refer to any business involved with selling or enabling the sale of products/services online. Typically, these companies operate an online marketplace where consumers or other businesses can order whatever items they need. And in an era of smartphones, laptops, and tablets, ordering a product through a website only takes a couple of clicks versus having to go to a physical store.

From a consumer’s perspective, online shopping provides immense convenience, especially today with next day shipping. For retailers, an online marketplace drastically expands the addressable market opportunity, enabling businesses to reach any customer across the country or even the entire world.

E-commerce shares can vary greatly. But most adopt one of four generalised business models:

- Business to Business (B2B) – These firms are focused on offering online products or services to other companies, who may, in turn, sell these products or services to their customers. By dealing with companies rather than consumers, the volume of spending tends to be high and more consistent. Some of the biggest e-commerce stocks that fall into this category include Amazon and Alibaba.

- Business to Consumer (B2C) – These operate almost identically to B2B e-commerce companies, except they target consumers directly. This is arguably one of the most common types of business in the world of online shopping. But it also encapsulates popular online services such as Netflix and Spotify.

- Consumer to Business (C2B) – C2B models allow consumers to offer their products and services to businesses directly. This is more common amongst affiliate marketing websites and freelance hiring platforms like Fiverr and Upwork.

- Consumer to Consumer (C2C) – C2C companies typically operate an online platform that enables individuals to sell items directly to other individuals. While these platforms often support B2C solutions, they’re predominantly populated by individuals looking to sell old or custom made artisan products. eBay and Etsy are some popular e-commerce shares within this segment of the sector.

For the e-commerce stocks that operate a platform rather than do any direct online retailing, the revenue stream typically consists of income from transaction fees. Merchants typically pay a small percentage fee on each sale. And that money is often reinvested into advertising campaigns to attract new users and sellers, creating a mini-network effect in the process.

What are the Main Risks to E-commerce Stocks?

Thanks to rapid innovation, the educational, financial, and technological barriers to entry for a new E-commerce company are virtually non-existent. This is why there are countless online websites today, and it creates an enormous amount of competition for these businesses.

As a result, building customer loyalty or exercising pricing power is very difficult. After all, it takes just a quick Google search to find alternative places to buy a product which might be cheaper. Having said that, the established players with strong distribution networks are less exposed to this risk as consumers often don’t mind paying a small premium if their purchase is delivered sooner.

This vast amount of competition makes customer experience a top priority for almost all e-commerce stocks. And rightfully so. Suppose an online store is slow or unresponsive, especially on the checkout page. In that case, customers may be quick to close and never come back. This means cyber security solutions are of utmost importance for e-commerce shares. Any breach of customer data could cause severe reputational harm.

Key Financial Metrics

Analysing e-commerce stocks is often similar to analysing a brick & mortar retailer. Here are some of what I believe are the most important metrics to watch when thinking about investing in E-commerce stocks.

- Average Sale Price – The average price a product is selling across the market. In this instance, the average selling price reveals how much a product is being sold across all major e-commerce platforms.

- Net Profit Margin – Reveals how profitable the business is. A company with a rising net margin is usually finding new ways to optimise operations and expenses. Logistics and distribution costs are often a major drain on a firm’s income.

- Gross Profit Margin – This metric is used to measure how much profit a company makes after removing the cost of actually securing the sale.

- Return on Assets – Measures how a company is using its assets to generate revenues. This is especially important for e-commerce shares that have physical stores in their portfolio as well.

- Transaction Volumes – Refers to the total number of transactions that are processed within a period. It helps the investor to know the shopping rate of a platform and is a driver of revenue growth.

- Average Shopping Cart Value – Reveals how much customers typically spend on the platform. A rising trend indicates customers are becoming more dependent on the service for their retail therapy.

Key Terms when investing in E-commerce stocks.

Below are some key terms investors should know when investing in e-commerce stocks.

- Abandonment – This happens when a potential customer starts the process of checking out a product but abandons it halfway.

- Cost per Acquisition (CPA) – This measures the cost of acquiring one paying customer when digital marketing campaigns are done.

- Customer Engagement – This measures the frequency and duration a customer uses and engages with an e-commerce brand or platform.

- Click-Through-Rate (CTR) – A percentage measurement that reveals how capable a company is able to attracting visitors to its platform, either through organic search or email marketing campaigns.

- Impressions – This number represents the number of times e-commerce content is displayed to a potential customer outside of the platform. It’s a metric used to judge the performance of marketing campaigns.

- Reach – The number of people a marketing campaign or e-commerce product/service can be offered to.

- Organic Traffic – This is the number of visitors to an online store or platform that came naturally rather than as a result of a marketing campaign. If a business is deriving most of its traffic through organic channels, it often has lower marketing expense requirements.

Market Size and Forecasted Growth of the E-commerce Industry

At the end of 2021, the e-commerce industry had an estimated market size of $13trn! As bonkers as that sounds, this could be about to get five times bigger.

According to a report by Research and Markets, the global e-commerce market size is expected to reach $55.6trn by 2027 at a compounded annual growth rate of 27.4%. This predominantly stems from non-western nations as urbanisation and internet penetration continue to accelerate.

While there are many competitors in the e-commerce market, Amazon dominates in North America. In fact, it holds a massive 40% market share. And in China, the leader in the space is Alibaba. Having said that, new e-commerce stocks have begun to pop up and give these businesses a good run for their money. That being said, let’s dive in to see the top e-commerce shares in the UK and the US.

Top E-commerce Stocks in the UK by Market Capitalisation

The table below shows the top e-commerce stocks listed on the London Stock Exchange in order of market capitalisation.

| Company | Market Cap. | Category | Description |

|---|---|---|---|

| Tesco (LSE:TSCO) | £21.41bn | B2C | Engage in grocery retail and banking services, offering its products online. |

| Ocado Group (LSE:OCDO) | £6.24bn | B2C, B2B | One of the UK’s biggest online grocery retailers with a focus on using robotics to automate order fulfilment. |

| J Sainsbury (LSE:SBRY) | £5.58bn | B2C | Operates as a food, general merchandise & clothing retailer. |

| ASOS (LSE:ASC) | £1.41bn | B2C | Operates as a global online fashion retailer. |

| Boohoo Group (LSE:BOO) | £1.04bn | B2C | Operates as an online fashion retailer with a focus on 16 to 40 years old. |

Top E-commerce stocks in the US by Market Capitalisation

Similarly, the table below lists the leading e-commerce shares in the United States in order of market capitalisation.

| Company | Market Cap. | Category | Description |

|---|---|---|---|

| Amazon Inc. (NASDAQ:AMZN) | $1.15trn | B2B, B2C | One of the largest online retailers, the company also operates the Amazon Web Services. |

| Alibaba Group Holding (NYSE:BABA) | $238.13bn | B2B, B2C | Provides tech infrastructure and marketing reach to merchants, brands and retailers alike. |

| Shopify Inc (NYSE:SHOP) | $50.61bn | B2B | Provides e-commerce platform & financial services to small as well as enterprise-scale businesses. |

| eBay (NASDAQ:EBAY) | $26.12bn | B2C, C2C | Operates a platform that connects buyers and sellers. |

| Etsy (NASDAQ:ETSY) | $11.71bn | C2C | Connects buyers and sellers in the US, UK, Germany, Canada, Australia, France & India. |

Should I buy e-commerce stocks in my portfolio?

As urbanisation and internet penetration increases globally, e-commerce stocks’ profit potential is bound to rise. That obviously creates new opportunities for firms in this sector, and with trillions of dollars being poured into this industry, it appears to be an attractive proposition for my portfolio.

However, in a world where consumer tastes and technology evolve so rapidly, there is no guarantee that dominant e-commerce shares today won’t eventually become dethroned by rising competition. Therefore, I’m personally taking a diversified approach when investing in e-commerce stocks. This may lower my returns, but it also helps to eliminate a significant chunk of risk.

RELATED: Everything investors need to know about investing in retail stocks

Discover market-beating stock ideas today. Join our Premium investing service to get instant access to analyst opinions, in-depth research, our Moonshot Opportunities, and more. Learn More

Prosper Ambaka does not own shares in any of the companies mentioned. The Money Cog has published Premium reports on Netflix, Etsy, Shopify, Ocado Group, and Tesco. Views expressed on the companies and assets mentioned in this article are those of the writer and therefore may differ from the opinions of analysts in The Money Cog Premium services.