Unless someone was living under a rock for the past couple of years, chances are they’ve heard about the GameStop (NYSE:GME) short squeeze. The story has been explained countless times at this stage, so why am I dragging it up again?

In October 2021, the SEC released a report titled “Staff Report on Equity and Options Market Structure Conditions in Early 2021”. It may not be immediately obvious from the title. But the report investigates what happened with GameStop and other meme stocks in early 2021. And as it turns out, a lot of what was being reported at the time was simply untrue. Let’s take a look at what actually happened.

The GameStop short squeeze

As a quick reminder, a small group of investors on a Reddit sub-forum called WallStreetBets spotted that the total short position against GameStop was exceptionally high. With a grudge against certain Hedge Funds, the group decided to buy the stock and encouraged others to do the same. The goal was to push up the share price to trigger a short squeeze.

But looking at the SEC report, this isn’t exactly what happened. Using data from the Consolidated Audit Trail, the regulator tracked the details of each executed trade during the period. And it reveals some interesting facts.

So, what happened?

Investor interest surrounding GameStop had actually been brewing on Reddit since 2019. It only peaked in 2021. On 11 January, larger media groups started picking up on the story as Ryan Cohen joined GameStop as its new CEO. Following this announcement, the stock closed at $20.65 per share or a 17% rise in a single day. With more media coverage about the short squeeze, trading volumes exploded. And by 28 January, the stock reached its highest point at $483 per share. That’s a 2,200% increase in the space of around two weeks.

The catalyst behind the sudden rise in price was entirely due to investors buying the stock to participate in the short squeeze. At the start of January, around 10,000 unique accounts were trading the stock. By the end of the month, this number had jumped to nearly 900,000.

The vast majority of these accounts were individual investors. According to the report, 2020 saw six million new accounts created, with platforms like Robinhood seeing an average account balance of $240. In addition, one million of these new accounts, on average, were held by 19-year-olds. Financial institutions were also buying the stock. And at the time, it was believed, this activity was due to hedge funds covering their short positions.

On 28 January, several brokerages began restricting trading of Gamestop, causing a crash in buying volume. Consequently, the GameStop share price fell to as low as $40.59 by 19 February. But by the end of the month, it regained momentum, with many believing a second short-squeeze was underway. However, this does not appear to be true.

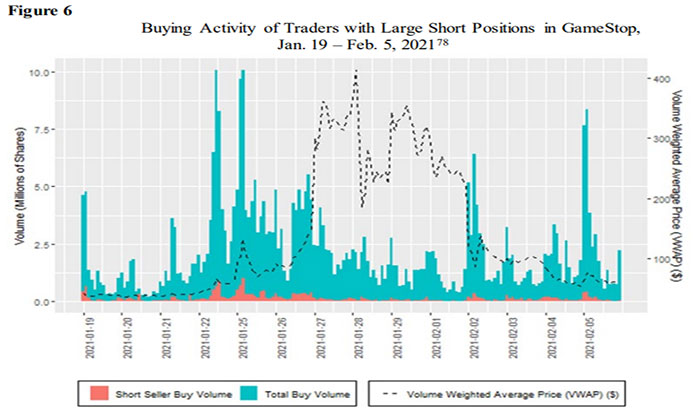

Looking at the chart, it’s clear to see that the short-covering volume only contributed a tiny fraction of the total buy orders. And this makes sense since most short-positions were covered in January. Meaning that a second short squeeze never happened. And the continued momentum of the GameStop share price is being driven by both individual and institutional investors opening long positions.

At the end of this early part of the GameStop situation, the hedge funds that shorted the stock realised some significant losses. However, many were able to hedge their bets. And those that bought the stock benefited from substantial profits. Overall, the SEC found that, on average, hedge funds were not significantly affected by the GameStop short squeeze or other meme stocks.

Misinformation and conspiracy theories

During January and February, quite a few conspiracy theories floated on social media designed to paint hedge funds in a bad light. But looking at the results of the SEC’s investigation, the allegations against these financial institutions appear to be false.

One example is the claim that hedge funds were participating in the illegal practice of naked shorting. But the data showed no persistent signs of failed order deliveries at the clearing member level. And on the occasion that orders did fail, they were quickly rectified within a few days. In other words, there is no evidence that any naked shorting took place.

A more widespread rumour was that trading platforms like Robinhood were conspiring with hedge funds to stop individual investors from buying GameStop. Hence why brokerages began restricting trading on 28 January. This, again, was proven to be untrue.

Brokers are legally required to keep a minimum cash balance at clearing houses to guarantee trade settlements that typically occur two days after an order is placed. As trading volume skyrocketed in January, more money was required. And clearing houses began issuing margin calls to brokers. And with limited resources at hand, trading volumes on platforms like Robinhood became restricted due to these capital requirements.

Payment for order flow also received a lot of scrutiny during this period. Individual investors began questioning whether off-exchange market makers were deliberately inflating the bid-ask spread. And once again, no unusual activity was discovered by the SEC’s investigation.

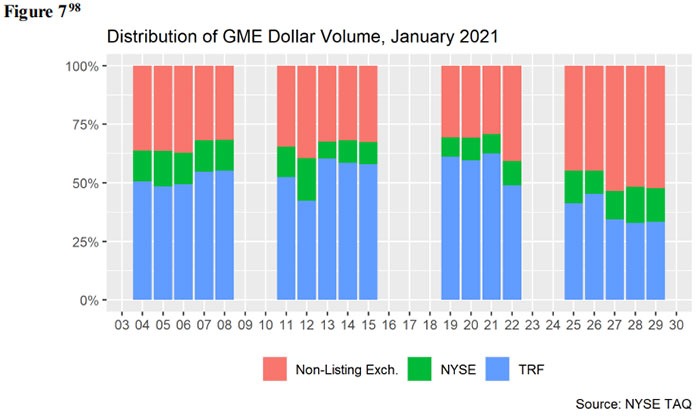

In fact, many market makers were struggling to match buy and sell orders since there was a very limited supply of the latter. And consequently, a large portion of orders sent through the payment for order flow transaction model were simply passed on to exchanges by market makers. The chart below shows the volume of GameStop shares processed by exchanges (green and red) and market markers (blue) during January.

Will the GameStop short squeeze lead to new regulations?

The report’s conclusion began questioning the ability of the markets to remain efficient during this unprecedented time. The SEC specifically highlighted the GameStop short squeeze situation as an opportunity to investigate the current market structure. And whether additional considerations need to be made to protect investors from misinformation.

Some of these proposals include shortening the settlement time to reduce risk at clearing houses. And, in turn, lower the cash requirements of brokers so that trading restrictions are less likely to occur. It also suggested that more transparency is needed for off-exchange market makers and improved reporting standards regarding short sales.

Lastly, the SEC also addressed the gamification of investing on platforms like Robinhood. This positive feedback loop ultimately encourages investors to trade more frequently, allowing larger profits to be generated through the Payment for Order Flow model. Thus, exacerbating the conflict of interest even further.

None of these points has been turned into new regulations as of yet. However, the chairman of the SEC, Gary Gensler, has been recently pushing for similar reform. Personally, I think the new regulatory proposals are pretty reasonable. Why? Because I believe the increased transparency and understanding will allow individual investors to make more informed decisions.

Discover market-beating stock ideas today. Join our Premium investing service to get instant access to analyst opinions, in-depth research, our Moonshot Opportunities, and more. Learn More

Zaven Boyrazian does not own shares in any of the companies mentioned. The Money Cog has published an investment report on Robinhood Markets. Views expressed on the companies and assets mentioned in this article are those of the writer and therefore may differ from the opinions of analysts in The Money Cog Premium services.