Investors’ interest in investing in renewable energy stocks and shares has spiked recently. This is amidst the accelerated transition to clean energy as the threat of global warming and climate change becomes ever more apparent. In fact, renewable energy is now the fastest-growing energy source in the world.

That certainly sounds like a stock market sector with potentially lucrative opportunities. So, with that in mind, what should investors consider before investing in renewable energy shares? Let’s dive in and explore the potential, the risks and which big players are currently leading the charge.

What are Renewable Energy Stocks?

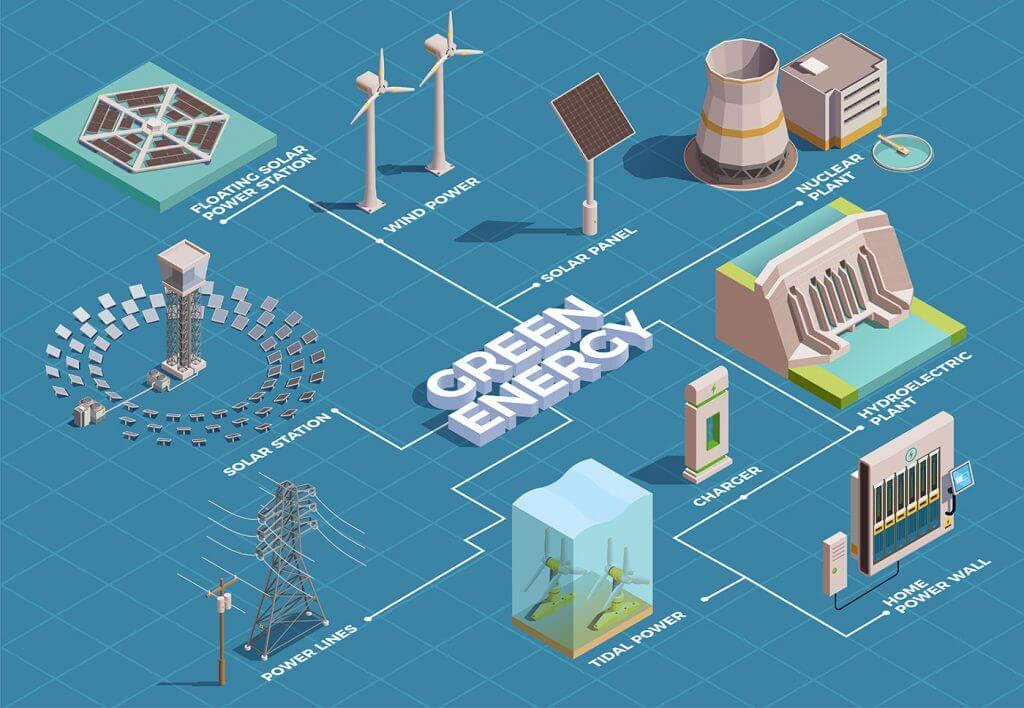

Renewable or green energy is a growing part of the larger energy industry. Since the signing of the Paris Climate Agreement has triggered a new wave of investment into this sector from governments and businesses alike. These companies use various forms of technology to generate clean electricity with no direct greenhouse gas emissions.

Fossil fuel remain the dominant source of energy in the world today. But in 2020, renewables were responsible for 28.6% of global electricity generation, according to the International Energy Agency. That’s up from 19.8% in 2010 and is expected to reach 61.2% by 2030.

Source: International Energy Agency

Companies operating in this space fall under a number of categories:

- Hydro – These are companies that utilise flowing water to generate clean energy. It is also known as hydroelectric power, and it accounts for about 37% of renewable electricity generation and 7% of total electricity generation in the US. Brookfield Renewable is arguably one of the leading renewable energy stocks in this category.

- Solar – These firms utilise sunlight to generate solar energy. Electricity is generated either directly through photovoltaic cells (solar panel), indirectly by the use of concentrated solar power, or by a combination of the two. NextEra Energy is one of the largest producers of solar energy in the US, while Foresight Solar Fund owns the largest solar energy farm here in the UK.

- Wind – Another set of businesses uses wind turbines to generate electricity. Wind farms can be found both on land and at sea. Greencoat UK Wind is one of the UK renewable energy stocks dominating this segment.

- Geothermal – This type of energy is generated when heat energy from the earth is captured and used for cooking, bathing, electrical power generation and more. Ormat Technologies is a pure-play geothermal energy renewable energy stock. Meanwhile, BP and Chevron have recently invested in this type of technology as well.

- Storage – Because renewable energy sources aren’t the most reliable, excess generated electricity needs to be stored for later use. This is a relatively new area of the renewable energy sector with only a few pure-play stocks like Gore Street Energy Storage Fund.

Just like the larger energy sector, renewable energy companies have a network of systems that handle green energy from production to it reaching the final consumers.

What are the Main Risks and Challenges?

No investment is risk-free. And renewable energy shares are no exception.

While the technology for generating clean electricity has become more efficient and drastically fallen in price over the last decade, it still requires substantial capital to establish and maintain this type of infrastructure. Consequently, many of these businesses are unprofitable and often rely on external financing through equity, debt, or both.

Beyond the high cash burn, these companies also command next to no pricing power. Electricity, much like other utilities, is highly regulated. Here in the UK, Ofgem sets limits as to how much energy companies can charge customers per unit of energy to both consumers and businesses alike.

Another key challenge is the process of securing permits to construct the various facilities. Constructing wind farms often receives particular backlash for their eyesore appearance and potential harm to birds. This is actually one of the lead reasons why offshore wind farms are becoming more common despite their higher construction and maintenance costs.

Key Financial Metrics to Consider Before Investing in Renewable Energy Stocks

- Debt-to-EBITDA – This ratio is used to measure a company’s ability to pay off its debts. Since these businesses are often reliant on large initial loans, verifying that a group has enough cash flows to service these debts is crucial. In my experience, anything higher than a value of 3x can be a sign to steer clear.

- Profit Margins – Refers to the profit that is left from sales after all expenses have been accounted for. Checking the degree of profitability versus competitors can quickly identify weaker players in this space.

- Debt-to-Capital – Measures a business’ financial leverage. The debt to capital ratio focuses on the relationship of a company’s debt liabilities as part of its total debt base.

- Debt-to-Equity – Measures the ratio of debt against the shareholders’ equity. It is a type of financial leverage ratio and is gotten by dividing the total liabilities by shareholders’ equity. This metric can quickly identify whether shares of a renewable energy business are over-levered.

Key Terms when Investing in Renewable Energy Stocks

Companies operating within the renewable energy sector have relatively simple business models. But like most industries, there is still a fair amount of jargon out there that’s seldom explained. Let’s take a look at a few terms investors should familiarise themselves with before investing in green energy stocks and shares:

- Biofuels – Refers to energy derived from biomass (living materials such as plants or algae, or animal waste).

- Combined Cycle – An electric generating technology that allows electricity and process steam to be produced from a lost waste heat that is exciting one or more combustion turbines.

- Demand – The rate electrical energy is delivered to or by a system. It is usually expressed in kilowatts (kW), megawatts (MW), or gigawatts (GW).

- Distribution– The movement of electricity to the retail customer’s home or business.

- Gigawatt-hour (GWh) – A unit of measuring energy. One gigawatt-hour equals 1,000 megawatt-hours.

- Grid – A network of electricity generators and providers that allows electricity to flow from the producer to the customers that are connected to it at various points.

- Kilowatt (kW)– The electricity rate utilised at a given period. It is used to measure the demand for power.

- Kilowatt-hour (kWh) – Measures the amount of electricity that is consumed over a period of time. It is for billing purposes. Customers are charged a rate per kWh of electricity used.

What is the Market Size?

According to a report published by Allied Market Research, the renewable energy market size stood at $881.7bn in 2020. This figure is projected to reach $1,977.6 billion by 2030 at a compounded annual growth rate of 8.4% between 2021 and 2030.

The growth is primarily driven by the increasing demand for clean energy as more countries and companies seek to eliminate their carbon footprint before the Paris Climate Agreement deadline in 2050.

Top Renewable Energy stocks in the UK by Market Capitalisation

Below are the five top renewable energy stocks in the UK in order of market capitalisation.

| Company | Market Cap. | Category | Description |

|---|---|---|---|

| SSE (LSE:SSE) | £19.93bn | Wind, Solar | Generates electricity from water, gas, coal, oil, multi-fuel, and solar power. |

| Greencoat UK Wind (LSE:UKW) | £3.50bn | Wind | A renewable energy group which invests in wind farm infrastructure through a network of subsidiaries to generate green electricity. |

| The Renewables Infrastructure Group (LSE:TRIG) | £2.97bn | Wind, Solar, Storage | Invests in assets which generate green energy from renewable sources. |

| ITM Power (LSE:ITM) | £1.91bn | Storage | The company designs, manufactures and sells hydrogen energy systems for energy storage, transportation, and the industrial sector. |

| Ceres Power Holdings (LSE:CWR) | £1.36bn | Storage | Develops and commercialises fuel cell technology in North America, Asia, and Europe. |

Top Renewable Energy Stocks in the US by Market Capitalisation

The table below shows the top five green energy stocks in the US by market capitalisation.

| Company | Market Cap. | Category | Description |

|---|---|---|---|

| NextEra Energy (NYSE:NEE) | $152.11bn | Wind, Solar | NextEra Energy generates, transmits, distributes, and sells renewable power to retail and wholesale customers in North America. |

| Duke Energy Corporation (NYSE:DUK) | $88.08bn | Wind, Solar | Operates as an energy company in the US. Generates energy using coal, hydroelectric, natural gas, oil, renewable sources and nuclear fuel. |

| Brookfield Renewable Partners (NYSE:BEP) | $23.22bn | Hydro, Wind, Solar | BEP generates electricity through hydroelectric, wind, solar, distributed generation, pumped storage, cogeneration, and biomass sources. |

| SolarEdge (NYSE:SEDG) | $15.53bn | Solar | Designs, develops, and sells direct current optimised inverter systems for solar photovoltaic installations worldwide. |

| Plug Power (NASDAQ:PLUG) | $11.02bn | Storage | provides hydrogen fuel cell turnkey solutions for the mobility, material handling, and stationary power markets in North America and internationally. |

Should I invest in Renewable Energy Shares?

As the 2050 deadline set by the Paris Climate Agreement draws closer, nations and organisations are doubling down on investment in renewable energy. That, to me, sounds like an excellent stock market sector to add exposure to for my portfolio as a long-term investment.

Having said that, this industry is still relatively in its infancy. And there are plenty of companies around today struggling to stay above water due to the capital intensive nature of the sector. Therefore, investing in renewable energy stocks and shares may not be suitable for everyone.

Discover market-beating stock ideas today. Join our Premium investing service to get instant access to analyst opinions, in-depth research, our Moonshot Opportunities, and more. Learn More

Prosper Ambaka does not own shares in any of the companies mentioned. The Money Cog has published a Premium report on Greencoat UK Wind. Views expressed on the companies and assets mentioned in this article are those of the writer and therefore may differ from the opinions of analysts in The Money Cog Premium services.