Renewable energy stocks are becare becoming investors’ hot picks. With climate change becoming an ever-present threat, the world is going through a fundamental shift towards a greener environment. And it’s given this stock market sector an enormous boost. Consequently, there are new companies focused on green energy popping up every month.

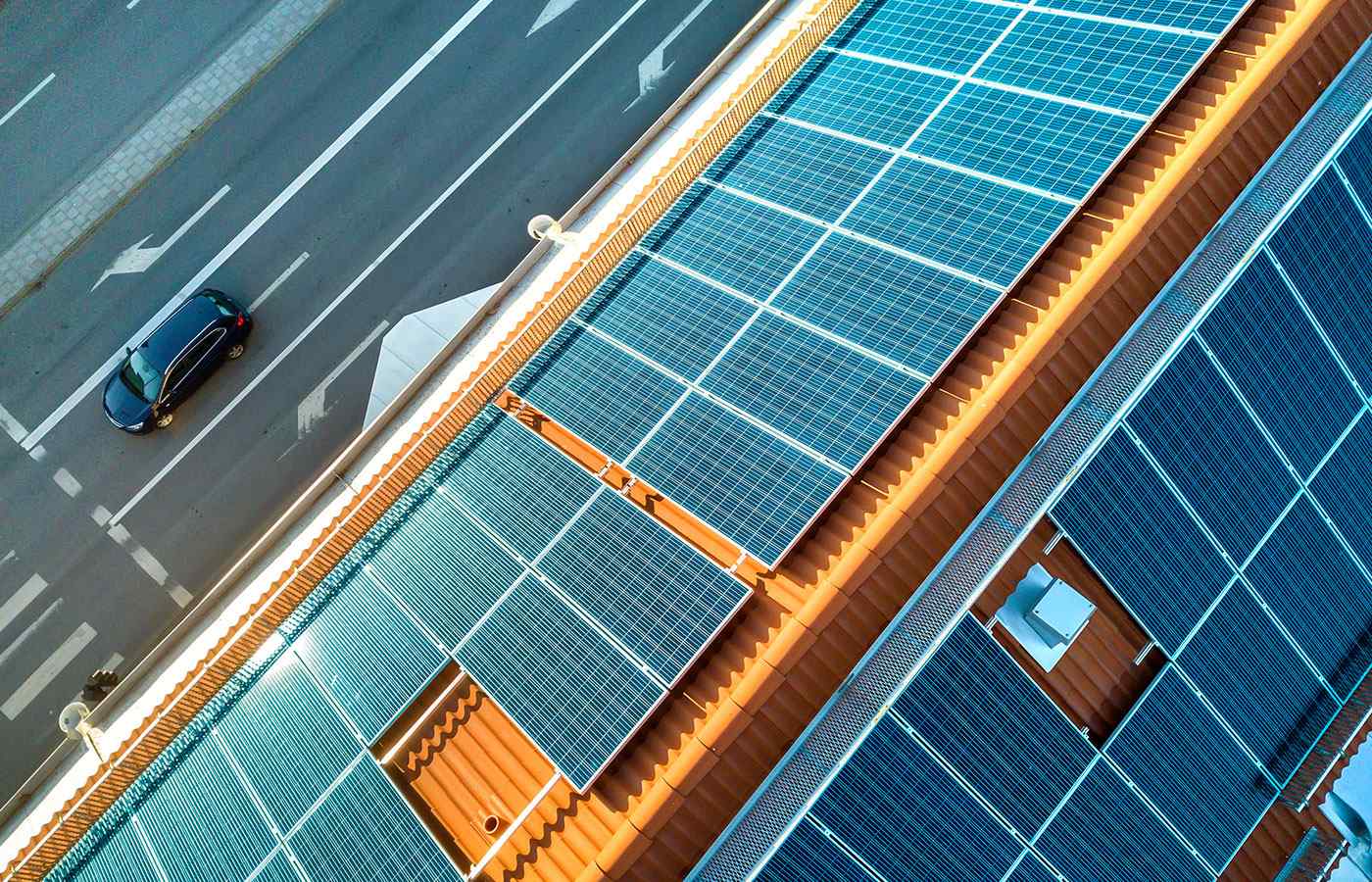

Beyond general sentiment in the markets, a primary contributor to the rise of this industry is thanks to the rapidly declining costs of the technology. According to the International Renewable Energy Agency (IRENA), from 2010 to 2019, the price of solar panels has reduced by 82%. Meanwhile, other technologies like concentrated solar power, onshore wind, and offshore wind have also fallen by 47%, 40%, and 29%, respectively.

Seeing this downward price trend is terrific news for the renewable energy industry. After all, since generating renewable power is largely a fixed cost process, the falling prices mean larger margins. And with demand for clean energy on the rise courtesy of electric vehicles, the timing couldn’t be better, in my opinion.

With that in mind, I’m keen to find the best opportunities for my portfolio. My colleague Prosper Ambaka has already explored his top pick for the best renewable US stocks. But what about in the United Kingdom?

There are plenty of exciting players in this space, including popular green energy stocks like Ceres Power, NextEra Energy, National Grid, ITM Power, and Greencoat UK Wind, to name a few. But out of all the firms I looked at, there are only two clean energy companies that caught my attention. I believe these businesses have the potential to explode in 2022 and beyond.

UK’s largest renewable energy stock

SSE (LSE:SSE) is one of the largest renewable energy producers in the UK. The country’s renewable electricity generation is expected to increase by almost 50% by 2025. And SSE appears to be already prepared to cash in on this. Management is setting up a separate subsidiary solely focused on alternative energy projects, such as offshore wind farms.

Moreover, the company’s rich core renewables and business networks coupled with well-positioned sites provide a solid foundation to transition the energy business towards net-zero carbon emissions. At least, that’s what I think.

A dividend income is one of the major attractions for investors like me. Undoubtedly, this renewable energy company has been offering an above-market-average dividend yield of 5.3%. But it’s worth noting that running an energy company is hardly cheap. Consequently, it has racked up a significant £8.4bn pile of debt that is quite concerning. If management cannot support the high degree of leverage, this business and its share price may struggle in the future.

RELATED: How to analyse utility stocks

The leading provider of power solutions

XP Power (LSE:XPP) is committed to being a leading provider of power solutions. Using its expertise, the firm produces electrical components that are used within renewable energy technology. Unsurprisingly the demand for such products is skyrocketing, leading to double-digit revenue growth so far this year. And I don’t think this will be disappearing anytime soon.

The cancellation of dividends in 2019 was a sad day for XP Power investors. After all, no one likes a dividend cut. But management was able to re-introduce payouts in the second quarter of 2020. This, coupled with an excellent cash conversion, shows signs of admirable in-house improvements and growth potential in my experience. But the firm is far from risk-free. XP Power faces rising competition from alternative manufacturers that may impede its future growth potential. If the quality of its products starts to suffer, rival groups may start stealing market share.

Nevertheless, the renewable energy stock’s past performance combined with high forecasted earnings makes it my portfolio’s top investment pick for 2022 and beyond.

Discover market-beating stock ideas today. Join our Premium investing service to get instant access to analyst opinions, in-depth research, our Moonshot Opportunities, and more. Learn More

Saima Naveed does not own shares in any of the companies mentioned. The Money Cog has published Premium reports on XP Power and Greencoat UK Wind. The Money Cog has no position in any of the companies mentioned at the time of writing. Views expressed on the companies and assets mentioned in this article are those of the writer and therefore may differ from the opinions of analysts in The Money Cog Premium services.