Pound cost averaging, or dollar cost averaging as it’s called in the United States, is a time-tested strategy to drip-feed money into the stock market.

Using this simple technique, investors can reduce the negative impact of poorly-timed investments. Almost no one, including professionals, can perfectly time the market. Therefore, investing small amounts over several weeks is a popular alternative that’s far more effective.

This strategy is also known as unit cost averaging, incremental trading, or average cost effect. The term was coined by famous investor Benjamin Graham, widely seen as the father of value investing in his book, The Intelligent Investor.

What is pound cost averaging?

Pound cost averaging is when an investor buys a small amount of a particular security – usually a stock, mutual fund, or index fund – in regular intervals spanning anywhere from a few weeks to several months.

The opposite of this tactic is called lump sum investing. And this is when an investor purchases all their desired shares in a single transaction on a specific date.

So what’s the point of using a pound cost-averaging strategy?

In the short term, movements in the stock market are incredibly difficult to predict. This is especially true when trading in a volatile period, and it’s not uncommon for the stock price of a high-quality business to plunge suddenly.

By spreading the buying activity for an investment over several weeks or months, the investor may be able to capitalise on the better price and buy more shares. In doing so, the average price paid for each share in the overall position is brought down. And this, in turn, opens the door to potentially higher returns if the share price rises in the future.

Example

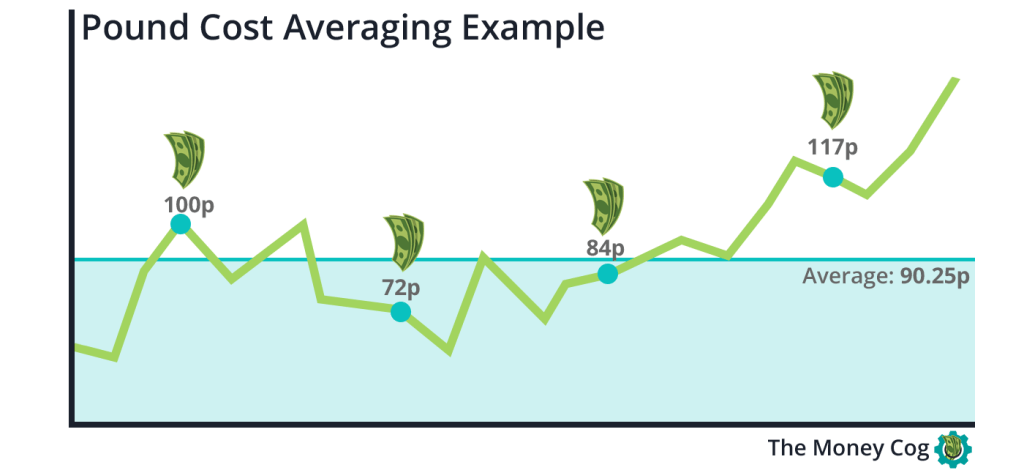

I want to invest £4,000 into ABC Group, but there has been quite a bit of stock market volatility recently. Therefore, I’m going to spread my buying activity in fixed intervals over four months.

| Month | Amount Invested | ABC Group Share Price | Number of Shares Purchased |

|---|---|---|---|

| January | £1,000 | 100p | 1,000 |

| February | £1,000 | 72p | 1,388 |

| March | £1,000 | 84p | 1,190 |

| April | £1,000 | 117p | 854 |

| £4,000 | 90.25p | 4,432 |

If I had chosen to invest all £4,000 into ABC Group in January, I would have received 4,000 shares at a price of 100p.

However, by spreading my buying activity over several months, I was able to buy more shares at an even better price. And by April, I had invested the same £4,000 but received an extra 432 shares at a better average price of 90.25p – a near 10% discount to what the lump sum investing approach yielded.

But of course, pound cost averaging can backfire. Let’s say I have another £4,000 I want to invest into XYZ Corp. And just like before, I’m going to spread my buying activity over four months.

| Month | Amount Invested | XYZ Corp Share Price | Number of Shares Purchased |

|---|---|---|---|

| January | £1,000 | 100p | 1,000 |

| February | £1,000 | 125p | 800 |

| March | £1,000 | 105p | 952 |

| April | £1,000 | 135p | 740 |

| £4,000 | 114.55p | 3,492 |

In the case of XYZ Corp, the rising share price meant each additional purchase was more expensive than the first. Consequently, the average price paid per share rose to 114.55p. By comparison, investing £4,000 in a lump sum in January would have resulted in a better purchase price of 100p.

What are the advantages and disadvantages of cost averaging?

As the earlier example demonstrated, pound cost averaging can be a lucrative investing strategy. But it’s not without its weaknesses. With that in mind, let’s explore the main advantages and disadvantages of using this trading tactic.

| Advantages | Disadvantages |

|---|---|

| It helps remove emotions from investing, preventing investors from being completely swept up in stock market hype. The end result is increased investment discipline. | If a stock price rises instead of falls, it can lead to a more expensive cost basis resulting in fewer shares being purchased compared to a lump sum investing approach. |

| Eliminates the pursuit of trying to time the stock market – something that often ends in failure. | A falling share price doesn’t necessarily guarantee a bargain. An investor may buy seemingly cheap stock, only to watch it tumble further once the capital has been used up. |

| If share prices fall, an investor can capitalise on the lower valuation by adding more shares to their portfolio at a better price. | Pound cost averaging requires more transactions to execute, resulting in higher trading expenses that can negate the benefits. |

Advantages and disadvantages of lump sum investing?

In some situations, lump sum investing may be the wiser course of action, even if it carries a higher risk. Let’s explore this alternative investment strategy by looking at the pros and cons.

| Advantages | Disadvantages |

|---|---|

| Investments are executed in a single transaction, keeping trading commission fees as low as possible. | If the share price falls after purchase, there is no capital available to capitalise on the lower prices. |

| Deploys capital into the stock market faster, putting money to work for longer can maximise the long-term benefits of compounding returns. | Investing in lump sums makes it easier to be caught up in stock market hype and excitement that may die down after a few weeks. |

| A well-timed lump sum investment can generate superior returns. However, this market timing is often down to pure luck. | If a business reveals a major flaw after the shares have been purchased, all money is at risk. By comparison, a pound cost averaging strategy could have stopped any further purchases of the compromised stock. |

Can you lose money with pound cost averaging?

No matter how well-researched an investment is, there is always a possibility that an investor will lose money.

It’s incredibly common for the value of even a high-quality investment to fall below the purchase price. At least in the short term. And the same is true even when pound cost averaging is deployed.

The investment strategy does not protect against losses on capital that has already been invested. But it can protect any uninvested capital from adverse price movements or even the revelation of a fundamental problem within the underlying asset.

For example, a company could announce it’s going to file for Chapter 11 Bankruptcy. The share price will understandably plummet, harming the value of the current investment. But now, the investor can avoid allocating any more capital to this compromised business.

The bottom line

While the pound cost-averaging method of investing is not perfect, it does help investors to stay disciplined, often leading to better investment decision-making.

One of the world’s most successful investors, Warren Buffett, strongly advocates using pound cost averaging, especially when the stock market is going through turmoil – “be greedy when others are fearful, and fearful when others are greedy”.

That’s why most professionals agree it’s the best buying strategy during volatile market conditions such as a bear market.

Discover market-beating stock ideas today. Join our Premium investing service to get instant access to analyst opinions, in-depth research, our Moonshot Opportunities, and more. Learn More

Prosper Ambaka does not own shares in any of the companies mentioned in this article. The Money Cog has no position in any of the companies mentioned. Views expressed on the companies and assets mentioned in this article are those of the writer and therefore may differ from the opinions of analysts in The Money Cog Premium services.