Investing in semiconductor stocks and shares can be quite a cyclical experience. 2021 brought unexpected growth to the sector, with many chip stocks exhibiting double-digit growth during the year. With demand skyrocketing and supply remaining constricted, this isn’t too surprising. But now that the supply chain situation is improving, the growth is expected to slow down back to normalised levels.

Despite the reduction in growth rate, investing in this stock market sector is still an attractive investment opportunity, in my opinion. And it would seem other analysts agree as the industry has a market size forecast of $1trn by 2030! Let’s explore and discover the growth potential, the risks, and what key trends to watch over the next decade.

What are Semiconductor stocks?

Semiconductors stocks include all companies involved in the business of making integrated computer chips for electronic applications. Given this microchip technology can be found in almost every business and consumer electronics device worldwide, the list of products is frankly endless. But some of the most common include random-access memory, static random-access memory, erasable program read-only memory, and analogue-sensitive, mixed-signal and power-conditioning chips.

Semiconductor companies can be typically placed into one of three groups:

- Chip Manufacturers – Any business involved in manufacturing semi-conductor chips to the specification provided by clients. Companies in this arena include Taiwan Semiconductor Manufacturing Company (TMSC), Samsung, and Intel.

- Fabless Chip Designers – These companies design semiconductor chips but do not manufacture them due to the complex nature of the operation. NVIDIA Corporation, Advanced Micro Devices, Broadcom and Qualcomm fall under this category.

- Chip-Equipment Makers – This category contains any business that manufactures the equipment needed to make semiconductor chips. It’s a niche field but has several businesses serving it, such as XP Power Ltd.

The majority of companies in this sector follow ‘the fabless business model’. And according to this model, manufacturers can invest profits in the research and development of new technologies. Moreover, this investment maintains the production volumes that are required to meet demand and support sales.

The Risks and Challenges of Semiconductor Shares

Every industry has its threats. And semiconductors is no exception. Let’s discuss some of the major challenges semiconductor stocks have to face:

- Increased Product Demand – Artificial Intelligence, the Internet of Things, and the continuous growth of smartphones are placing massive stress on the semiconductor supply chain. Moreover, this challenge is further heightened by ongoing international trade disputes. As a result, a massive order backlog continues to build up creating a global chip shortage. While this has resulted in higher prices, it’s also brewing new competitors seeking to steal market share.

- Sustaining Competitive Advantages – Steady technological improvements have become necessary in the semiconductor industry. And every detail matters! Suppose a competitor’s product is better in any aspect. In that case, it could erode a huge chunk of revenue from the semiconductor company’s financial reports. Hence keeping up with the competition is one of the major challenges for all semiconductor producers.

- High R&D and Capital Costs – New chip designs and process technologies are becoming increasingly expensive. Also, the R&D required on the back end is continuously rising. The increasing amount of capital needed to build state-of-the-art chips adds to the industry’s challenges.

Key Financial Metrics to Know before investing in Semiconductor Stocks

Given the complexity of these businesses, it’s important to know what factors should be monitored by an investor. There are plenty of vital metrics to consider. But in my opinion, the most critical when it comes to semiconductor stocks are:

- R&D as a Percentage of Revenue – Because innovation lies at the heart of this industry, seeing semiconductor stocks invest a stable or growing proportion of their revenue stream into research & development is an encouraging sign, in my experience.

- Revenue Growth – This financial metric is key for growth. It indicates whether the company is generating enough revenue that is required to sustain leading-edge fab investments.

- Debt Financing – Debt is common amongst semiconductor businesses due to the high-cost nature of the industry. Used correctly, debt can be a powerful lever to fuel growth. But too much and profits start to take a hit.

- Return on Invested Capital – Optimization of ROIC is very important in the case of semiconductor stocks. It measures how much value the company creates for shareholders beyond what it has invested in its operations.

Key Terms to Know before Investing in Semiconductor shares

This sector is filled with a lot of jargon that is rarely explained. Here are some key terms to be aware of when reading through earnings reports and presentations from semiconductor stocks.

- Semi-conductor vs Conductor – A semiconductor essentially functions as a hybrid of a conductor and an insulator. Whereas conductors are materials with high conductivity that allow the flow of charge.

- N-Type Semiconductor – N-type semiconductor is a mixed impurity chip that has phosphorus, arsenic, antimony, and/or bismuth.

- P-Type Semiconductor – A P-type semiconductor is a type of extrinsic chip that contains boron and aluminium. These impurities increase the conductivity capacity of a regular semiconductor.

- Intrinsic Semiconductor – Unlike N-type and P-Type semiconductors, intrinsic or pure semiconductors do not have any impurities.

- Wafer – A wafer is a physical unit used for manufacturing semiconductor devices.

- Automatic Defect Review – This feature observes, classifies and analyses the shape and components of the defect and particles detected by the wafer inspection system in greater detail.

- Micro Electro Mechanical Systems (MEMS) – These are ultra-compact systems composed of micro-mechanical components such as sensors, actuators, and electronic circuits on a silicon wafer using the microfabrication technology for semiconductor manufacturing technology.

- Etch System – An etch system shapes the thin film into desired patterns using liquid chemicals, reaction gases, or ion chemical reactions.

- Integrated Circuit – An electronic device that comprises numerous functional elements such as transistors, resistors, condensers, etc., on a piece of a silicon semiconductor substrate and is sealed inside a package with multiple terminals.

Market size and Forecasted Growth of the Semiconductor Industry

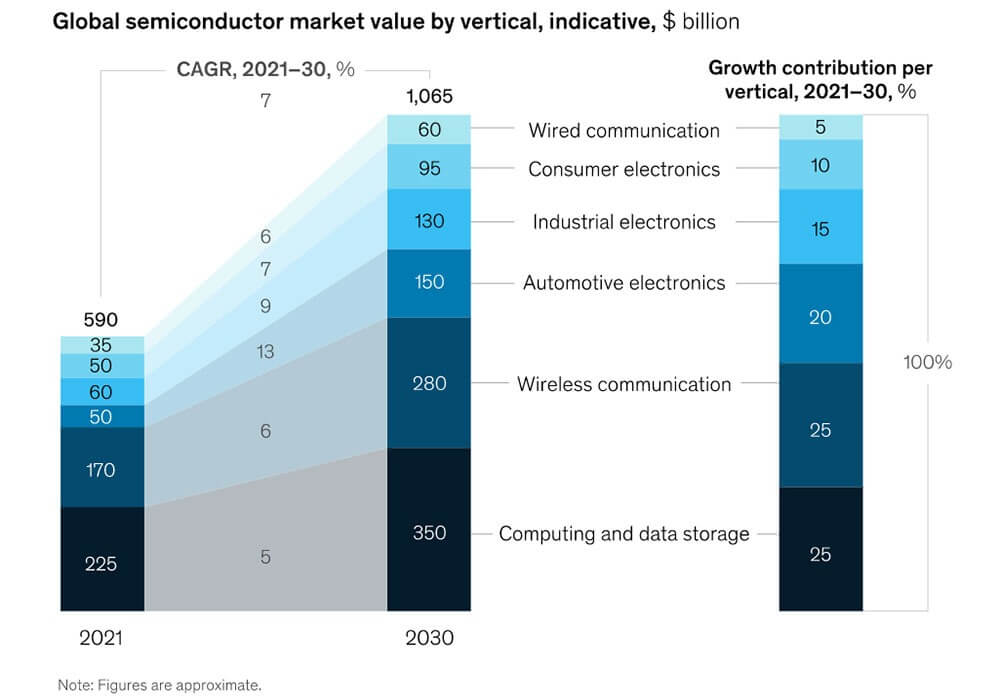

The semiconductor sector is booming. In fact, with the increase in the pace of digitalisation, global sales have jumped almost 20% in 2021, according to a report by McKinsey & Company. It also predicted the industry will continue to grow by a respectable 6-8% over the next decade, reaching a $1trn market size by 2030.

This growth is expected to be primarily driven by three major catalysts:

- Automotive

- Wireless Communication

- Computation & Data Storage

Within these segments, automotive is likely to experience three times the growth in demand. Why? Because of the innovations being made in autonomous driving and e-mobility. In fact, this segment alone is predicted to represent roughly 20% of the industry’s expansion.

The slowest contributor is likely to be Computation & Data Storage. But, it still represents a significant chunk of the industry. And with demand for servers, AI, and cloud computing continuing to grow, this is unlikely to change.

A similar story exists with the Wireless Communication segment. With 5G entering the picture, along with continued demand for smartphones in both developed and undeveloped nations, growth is expected to continue.

Interesting Facts about the Semiconductor Industry

According to the Semiconductor Industry Association:

- The US semiconductor industry is the worldwide industry leader, with about half of the global market share and sales of $258 billion in 2021.

- Nearly half of US semiconductor manufacturers’ production is done in the United States.

- The United States exported $60 billion in semiconductors in 2021.

Top Semiconductor Stocks in the UK by Market Capitalisation

| Company | Market Cap. | Category | Description |

|---|---|---|---|

| Alphawave IP (LSE:AWE) | £908m | Chip Manufacturers | This semiconductor stock designs, develops, and sells digital signal processing (DSP)-based multi-standard wired connectivity silicon IP solutions. |

| XP Power Ltd. (LSE:XPP) | £599m | Chip-Equipment Makers | Designs, develops, and manufacturers electronic components for devices across multiple industries, including semiconductor manufacturing. |

| IQE (LSE:IQE) | £230m | Chip Manufacturers | It develops, manufactures, and sells advanced semiconductor materials. |

| Nanoco Group (LSE:NANO) | £87.5m | Fabless Chip Designers | It engages in the research, development, manufacture, and licensing of novel nanomaterials for use in various commercial applications. |

| CML Microsystems (LSE:CML) | £62m | Fabless Chip Designers | It designs, manufactures, and markets mixed-signal, radio frequency (RF), and microwave semiconductors for communications markets worldwide. |

Top Semiconductor Stocks in the US by Market Capitalisation

| Company | Market Cap. | Category | Description |

|---|---|---|---|

| NVIDIA Corp (NASDAQ:NVDA) | $ 440bn | Fabless Chip Designers | It provides graphics, computing, and networking solutions in the United States, Taiwan, China, and internationally. |

| Broadcom Inc (NASDAQ:AVGO) | $237bn | Fabless Chip Designers | It designs, develops, and supplies various semiconductor devices with a focus on complex digital and mixed-signal complementary metal oxide semiconductor-based devices and analogue III-V-based products worldwide. |

| Intel (NASDSAQ:INTC) | $179.9bn | Chip-Equipment Makers, Fabless Chip Designers | It engages in the design, manufacture, and sale of computer products and technologies worldwide. |

| Texas Instruments (NASDAQ:TXN) | $155.1bn | Chip-Equipment Makers, Fabless Chip Designers | It designs, manufactures, and sells semiconductors to electronics designers and manufacturers worldwide. |

| Qualcomm (NASDAQ:QCOM) | $153.2bn | Fabless Chip Designers | It engages in the development and commercialisation of foundational technologies for the wireless industry worldwide. |

Should I Invest in Semiconductor shares?

Semiconductors are becoming increasingly important in modern technology. Thanks to these electronic components, businesses and individuals alike have become smarter, faster, and more efficient.

Technologies such as 5G wireless, artificial intelligence, the Internet of Things, cloud computing, and machine learning are only just getting started. And that’s why, in my opinion, semiconductor stocks have a vital role to play in my portfolio.

Investing even in the best semiconductor stocks has its risks, of course. But given the opportunity that lies ahead, I personally believe these risks are worth taking.

Discover market-beating stock ideas today. Join our Premium investing service to get instant access to analyst opinions, in-depth research, our Moonshot Opportunities, and more. Learn More

Saima Naveed does not own shares in any of the companies mentioned. The Money Cog has published Premium reports on NVIDIA Corp and XP Power Ltd. Views expressed on the companies and assets mentioned in this article are those of the writer and therefore may differ from the opinions of analysts in The Money Cog Premium services.