Investing in pharmaceutical stocks and shares can be a lucrative endeavour. Beyond the high growth potential the stock market sector offers, actively investing in pharmaceutical shares helps support the research and development of new treatments and medicines worldwide.

Let’s explore the details of this industry, looking at the impressive growth opportunities but also the risks that investors ought to know about.

What are Pharmaceutical Stocks?

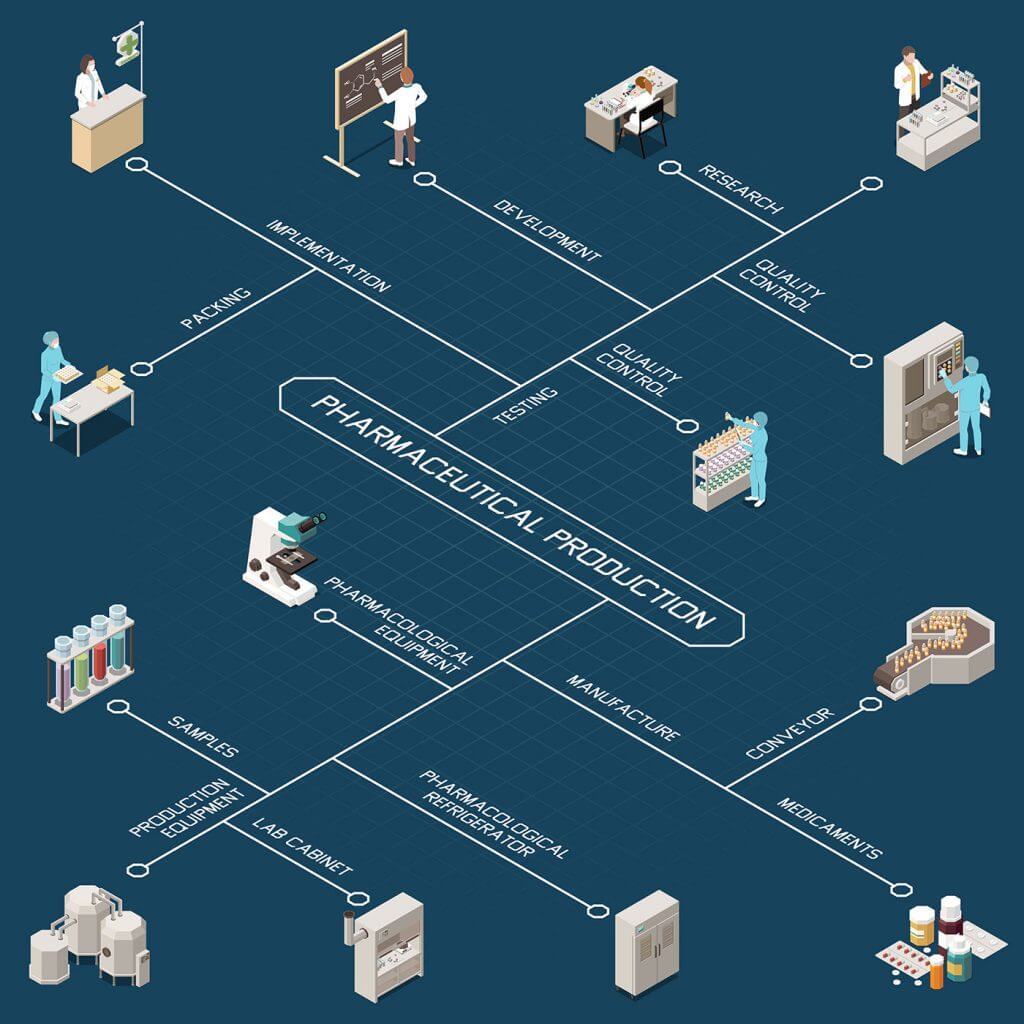

These are the companies that research, develop, manufacture and market/distribute drugs/healthcare products. They are a subcategory of Healthcare stocks and are similar to Biotech stocks. However, the key difference between a pharmaceutical and biotech stock is that the drugs are derived from chemical bases rather than organic ones.

This industry plays a critical role in sustaining human life. Companies in the pharmaceutical sector produce products such as vaccines, antibiotics, steroid hormones, and human blood plasma for patients.

There are three categories in which pharmaceutical shares can be organized.

- Mainline – These groups are otherwise known as brand developers. These are the large and established pharmaceutical firms often referred to as big pharma. Some industry leaders include Pfizer, GlaxoSmithKline, AstraZeneca, Gilead Sciences, and Bristol Myers Squibb.

- Research & Development – Typically, most pharmaceutical firms engage in research and development. But companies organized in this category refer to those that may not have approved products on the market. Instead, their products are either in discovery or clinical trials, or the group may be a subcontractor for larger mainline firms.

- Generics – These refer to businesses that manufacture drugs no longer protected by patents. While these companies may not have any blockbuster projects in development, improving access to medicines through generics is still highly profitable and lowers medical bills for patients. One of the biggest generic pharmaceutical stocks in the world is Teva Pharmaceuticals.

What are the Main Risks to Pharmaceutical Shares?

As much as I like the pharmaceutical industry for the critical role it plays in society, I am cautious of the risks and challenges these companies have to face. It is worth noting that no stocks are risk-free, including pharmaceutical shares. Before investing in even the best pharmaceutical stocks, investors should take note of the following:

- High Regulation – The pharmaceutical industry is one of the most heavily regulated sectors in the world. And it makes sense, given these drugs could harm rather than heal. But as a consequence, developing new treatments becomes significantly more expensive. And any breach of regulation, accidental or otherwise, can lead to severe legal and financial penalties.

- High Failure Rate – Being a regulated sector, every healthcare product (medicine, medical device, or treatment) needs to be given the green light by regulators before it can be sold on the market. The approval process is challenging, to say the least, and typically requires extensive clinical trials before an application can be submitted. Receiving a rejection letter from the FDA (US) or the MHRA (UK) is not uncommon. And for young Research & Development pharma stocks, it can be a death sentence. For reference, less than 10% of Phase 1 drugs make it to market.

- Competition – Despite the high barriers to entry, this sector still has plenty of players to compete with. And even the Mainline businesses can be threatened. After all, patents only last around 20 years, half of which is typically gobbled up during the drug development phase. That leaves a relatively limited window for these pharma companies to profit before the generics come in and steal market share.

Key Financial Metrics to Consider before Investing in Pharmaceutical Stocks

The intelligent investor does a proper analysis of a stock before investing any of their money. With that in mind, let’s look at some of the leading financial ratios I believe provide valuable insight when thinking about investing in pharmaceutical shares.

- Return on Research Capital Ratio (RORC) – This ratio shows the gross profit that a company makes from every dollar they spend on R&D. RORC is important as pharmaceutical firms invest heavily in R&D as new successful discoveries often translate into revenue growth in the future.

- Profitability Metrics – These include gross profit margin, operating profit margin, and net profit margin. They allow investors to assess a pharmaceutical company’s ability to generate earnings as compared to its expenses. The higher these ratios, the better.

- Return on Equity – This ratio measures the net income of the company in relation to the shareholders’ equity. It provides some good insight into how effectively a company is able to transform shareholder equity into profits.

- Current Ratio – A measure of a company’s ability to maintain a good level of liquidity and being able to manage its short-term debt. Since pharma stocks have to invest heavily in research & development, seeing a high degree of financial leverage is not uncommon. But it’s important to verify whether the business can maintain its pile of loan obligations.

Key Terms When Investing in Pharmaceutical Stocks

This sector is unsurprisingly complex. And there is a lot of jargon thrown around that can make investing in pharmaceutical shares a bit confusing. Let’s shed some light on some common terminology.

- Branded Product – Refers to products that are protected by patent or have an expired parent but are still sold by the original developer even if generic equivalents exist.

- Biosimilar – Refers to a therapeutic alternative to a first-in-class biological product.

- Retail Drugs – These are all the medicines available to consumers without needing a prescription from a doctor.

- Wholesale Acquisition Cost (WAC) – This is the price of a medication set by a pharmaceutical manufacturer.

- Speciality Drug – Refers to medicines that require a special supply chain. They are also costly as compared to retail drugs.

- Innovator Pharmacy – A medicine that’s the first of its kind. Once the patent expires, generic and biosimilar products are often made based on them.

- Average Wholesale Price (AWP) – This refers to the average price for medications sold at the wholesale level to hospitals and pharmacies.

- Health Plans – These are the insurance coverage policies that individuals pay for healthcare. In the UK, this tends to be quite rare as healthcare is free at the point of access. However, in the US, an insurance plan is often required to receive any treatment.

- Actual Acquisition Cost (AAC) – This is the true cost of what pharmacies and drug dispensaries have to pay to stock their shelves.

- Average Manufacturer Price (AMP) – This refers to the average price wholesaler and other large purchasers pay to manufacturers for drugs that are sold to retail pharmacies.

What is the Market Size?

The pharmaceutical sector and medical industry, in general, have been one of the most profitable industries in recent decades. For instance, the FDA approved 55 novel drugs in 2021. These new products will continue to drive growth in the pharmaceutical industry creating multi-billion dollar opportunities for their respective companies.

According to a report by Market and Research, the global market size of the pharmaceutical industry stood at $1.2trn in 2020.

But this is quite a diverse arena. Just looking at generics, this segment is expected to grow from $411.6bn in 2020 to $650.3bn by 2025. This is at a compounded annual growth rate (CAGR) of 9.6% between 2020-2025.

In the same vein, the global market for oncology (cancer) pharmaceuticals is expected to grow from $177.4bn in 2021 to $313.7bn by 2026 at a CAGR of 12.1%.

While the global market for orphan drugs is projected to grow from $190.8bn in 2021 to $248.2bn by 2026 at a 5.4% CAGR.

It is noteworthy that investors in pharmaceutical shares do not lack choices. There are scores of drug companies operating in the sector. While there are big players, some small pharma companies also produce novel medicines.

Top Pharmaceutical Stocks in the UK by Market Capitalisation

Here are the top five UK companies listed on the London Stock Exchange in order of market capitalization.

| Company | Market Cap. | Category | Description |

|---|---|---|---|

| AstraZeneca (LSE:AZN) | £163.33B | Mainline | The pharma stock focuses on the discovery, development, manufacturing and commercialization of prescription medicine. Recently it was responsible for a Covid 19 vaccine. |

| GlaxoSmithKline (LSE:GSK) | £90.63bn | Mainline | Engages in the creation, discovery, development, manufacturing and marketing of pharmaceutical products. |

| Hikma Pharmaceuticals (LSE:HIK) | £3.95bn | Mainline, Generics | Develops, manufactures and markets generic and branded pharmaceutical products. |

| Dechra Pharmaceuticals (LSE:DPH) | £3.75bn | Mainline | Develops, manufactures, regulates and markets veterinary pharmaceutical products. |

| Alliance Pharmaceuticals (LSE:APH) | £600.96m | Mainline | Acquires markets and distributes consumer healthcare and prescription medicine products. |

Top Pharmaceutical Stocks in the US by Market Capitalisation

Below are the top five largest pharma stocks in the US by market capitalization.

| Company | Market Cap. | Category | Description |

|---|---|---|---|

| Johnson & Johnson (NYSE:JNJ) | $472.18bn | Mainline | Researches, develops, manufactures and sells healthcare products. |

| Pfizer Inc (NYSE:PFE) | $296.70bn | Mainline | Discovers, develops, manufactures, markets and distributes various biopharmaceutical products. |

| Eli Lilly (NYSE:LLY) | $287.52bn | Mainline | Discovers, develops, and markets human pharmaceutical products worldwide. |

| AbbVie Inc (NYSE:ABBV) | $261.59bn | Mainline, Generics | This pharma company discovers, develops, manufactures and sells pharmaceutical products worldwide. |

| Merck & Co (NYSE:MRK) | $237.28bn | Mainline, Generics | Discovers, develops and manufacture human pharmaceutical and animal health products. |

Should I Invest in Pharmaceutical Stocks?

Pharmaceutical companies generallly rose to the challenge of the Covid-19 pandemic and manufactured vaccines in record time. This clearly shows how innovative companies operating in this industry are. I have no doubts that pharma companies will continue to play critical roles and help the world live healthier.

Consequently, I’m confident there are plenty of investment opportunities to be discovered in the life sciences industry. And it would seem experts agree since it’s common to see mainline businesses in the portfolios of mutual funds.

That being said, I recognize that investing in pharmaceutical shares has a fair amount of risk attached. And therefore, for investors with low tolerance to risks, there are probably “safer” industries in the stock market to explore. Personally, I believe the risk is worth the potential reward for my portfolio.

Discover market-beating stock ideas today. Join our Premium investing service to get instant access to analyst opinions, in-depth research, our Moonshot Opportunities, and more. Learn More

Prosper Ambaka does not own shares in any of the companies mentioned. The Money Cog has no position in any of the companies mentioned. Views expressed on the companies and assets mentioned in this article are those of the writer and therefore may differ from the opinions of analysts in The Money Cog Premium services.