Investing in gaming stocks and shares can be an exciting journey. In recent years, this stock market sector has seen unprecedented growth. And current industry forecasts indicate this momentum is only getting started. Of course, this doesn’t come as a risk-free guarantee. And there are plenty of threats that these businesses have to deal with.

So, let’s explore the area in more detail and discover just how big the investment opportunity is and what risks I think investors need to watch out for.

What are Gaming Stocks?

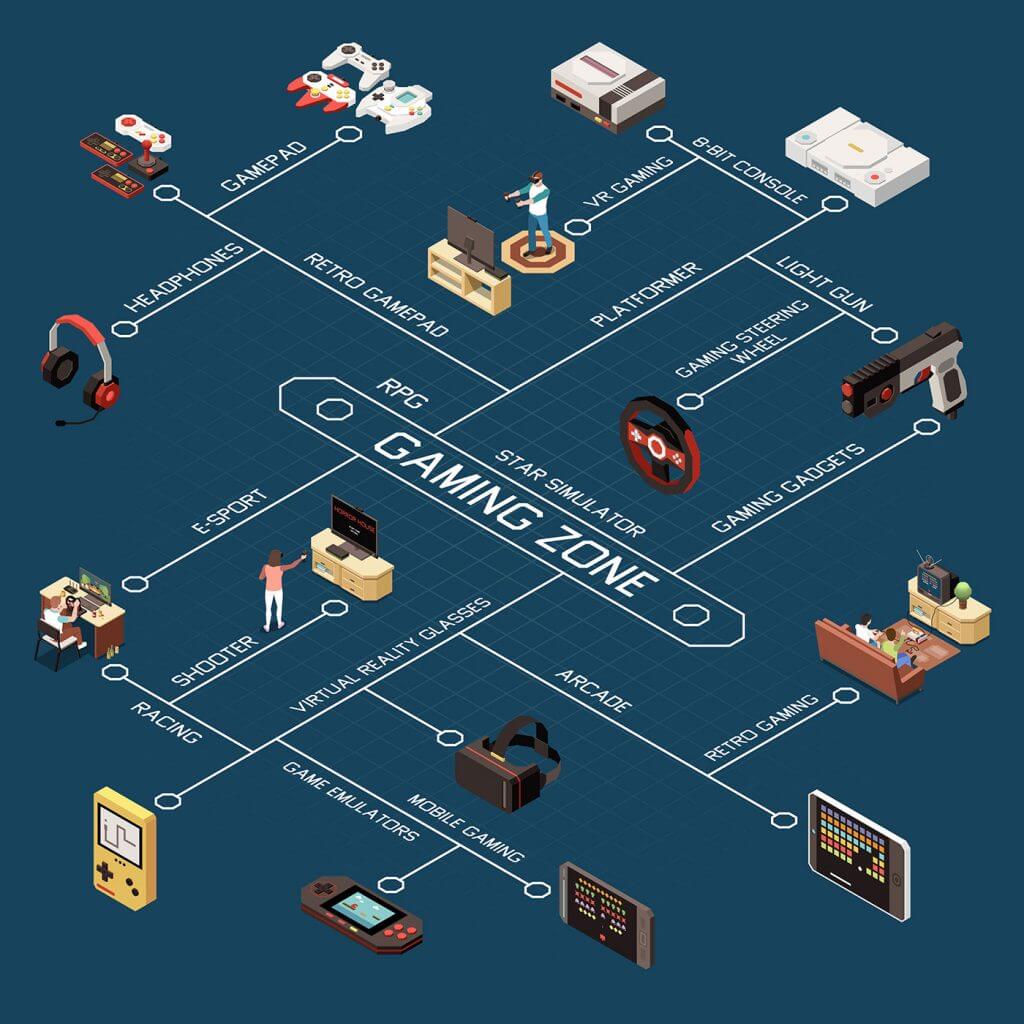

Gaming stocks are part of the entertainment industry. From the start, this sector was majorly comprised of businesses in one of three categories.

- Development Studios – The companies making games or the tools and software used throughout the industry. Some of the leading businesses in this segment include Ubisoft, Take-Two Interactive, and Unity.

- Publishing Houses – These firms help market and distribute games around the world, usually in exchange for royalty from each sale. Gaming shares like Electronic Arts, Frontier Developments and Take Two Interactive are both examples of publishers. However, they also have their own development studios as well.

- Gaming Devices – Excluding mobile, gaming is typically done on consoles and PC. This segment contains all the companies involved in developing and manufacturing these devices. The most prominent names in this segment are arguably Microsoft, Nintendo, and Sony.

The business model of these companies has evolved over the years. And today, with digital distribution channels becoming the dominant delivering method for gamers, there are multiple ways a company can make money.

The most common among consoles resembles a razor and blade, business model. These companies sell devices at relatively low margins but then take a small fee from game sales on their console’s respective online marketplaces.

Alternatively, studios sometimes adopt a free-to-play model, where gamers can download and play the game without having to fork over a dime. The studios then introduce micro-transactions where players can choose to buy exclusive premium content to enhance their experience.

This is something that popular multiplayer online games such as Fortnite and League of Legends have implemented. And at scale, it can be a far more lucrative approach to monetisation. That’s why it’s the preferred go-to monetisation method for mobile gaming.

The Risks and Challenges Faced by Gaming Shares

The growth of gaming shares is obviously linked with the performance of the underlying company. And that makes this growth susceptible to industry-specific risks that each of these firms has to contend with.

The gaming industry is filled with unexpected project failures and quality issues. And some of these belong to well-known gaming companies, indicating that no one is really immune to the risk of a flop – even with an enormous budget.

There are plenty of examples. But one recent one would be Frontier Developments. Despite having a solid track record of releasing popular titles, the Odyssey expansion to its Elite Dangerous franchise didn’t exactly meet expectations from gamers.

With that in mind, let’s explore the most prevent and potentially damaging risks investing in gaming stocks exposes a portfolio to.

- Heavy Reliance on Third-Party Developers – Video game stocks are expected to grow in the near future as the gaming industry foresees exponential growth. With the number of users increasing, the pressure on developers further increases to meet demand and maintain quality standards. Hence, massive dependency on third-party developers is a significant concern for all gaming companies.

- High Cost of Production – No doubt, video games and consoles have become highly profitable. But what is hidden from the end user’s eye is the massive cost of production. Video games are expensive and time-intensive to produce. In fact, depending on the scope, these projects can cost as much as $265m. Needless to say, if that much capital is invested and the game fails, it could be the end of the studio’s life.

- Moral Issues – Computer games are often the target of moral issues. They are labelled as making children addicted and oblivious to their surroundings. And opponents of the sector also stipulate how violent video games are corrupting and desensitising children. While this has been scientifically disproven, the stigma remains and could eventually lead to tighter regulations impacting future growth.

- Increasing Marketing Costs – The marketing costs within the gaming industry have seen a continuous hike in the past years. The primary reason behind this is to earn top-rank visibility in an increasingly competitive market. But what’s raising concerns is that the dollars spent are leading towards low-quality users, especially for free-to-play games. In other words, marketing may be attracting more players, but those players aren’t performing any microtransactions. As a result, this investment is sometimes yielding no return on investment.

Key Financial Metrics

The gaming industry is characterised by new technological and software advancements, which include virtual reality and augmented reality. That’s why I like to keep a keen eye on how these companies can maximise this innovation to attract new players.

There are quite a few ways of doing this. But the key financial metrics I tend to follow for gaming stocks are:

- Sales Growth – Is the company able to increase its overall sales?

- Digital Revenue – How much of the group’s revenue stream comes from digital channels? Digital tends to have higher margins. Therefore seeing it become a more prominent contributor to the revenue stream is an encouraging sight, in my opinion.

- Earnings Growth – How fast are the earnings growing relative to sales? If the growth is slower, it could indicate a growing build-up of poor-quality users or inefficient production expenditures as operations ramp up.

- Price to Earnings Ratio – The P/E is one of the easiest and fastest ways to see check if gaming stocks’ valuations are getting a bit overheated. While it’s not a good metric for discovering the true intrinsic value of a business, it does serve as a ballpark guideline. If shares of a gaming business are trading at a high multiple, but the sales or earnings growth isn’t there to back it up, it’s likely a warning sign of volatility ahead.

Key Terms to Know When Investing in Gaming Stocks

Before considering investing in gaming shares, there is a bit of jargon every investor ought to know about.

- Daily Active Users (DAU) – DAU is the number of unique users that start at least one session in your app on any given day. This is particularly important for multiplayer and mobile games.

- Sessions – Whenever a user opens a game app, it is considered a session. And the average number of sessions per DAU indicates how involved the users are with the game.

- Retention – Retention is an important metric in the currently popular free-to-play games market. Strong retention indicates a good relationship with the user.

- Conversion Rate – The conversion rate indicates the percentage of unique users who have purchased out of the total number of users during a specific time period. Generally speaking, the higher, the better.

- Average Revenue Per Daily Active User (ARPDAU) – ARPDAU is a handy metric as it tells how the game is performing on a daily basis in terms of generating revenue.

- Average Revenue Per Paying User (ARPPU): ARPPU describes how much players who have previously made a purchase are spending today.

Market size and Forecasted Growth

The Covid-19 led lockdown spiked the public’s interest in gaming platforms to pass the time. Streamlabs and Stream Hatchet’s reported that Amazon’s gaming platform Twitch live-streamed 6.3 billion hours in the first three months of 2021. That’s more than the whole of YouTube Live and Facebook Gaming.

Since then, things have calmed down. After all, people eventually went back to work and school. But current data indicates the pandemic surge actually accelerated the adoption and subsequent growth of the video game industry.

According to Mordor Intelligence, the gaming market will hit a whopping $339.95bn by 2027. By comparison, in 2021, the industry was valued at around $198.4bn. And is expected to grow by an impressive 8.94% over the next half-decade.

Top Gaming Stocks in the UK by Market Capitalisation

| Company | Market Cap. | Category | Description |

|---|---|---|---|

| Keywords Studios (LSE:KWS) | £1.67bn | Development Studio | It provides integrated outsourced creative and technical services to the biggest studios in the video game industry. |

| Devolver Digital (LSE:DEVO) | £641m | Publishing House | This video game stock publishes smaller scale indie titles on various platforms, including PC and console. |

| Team17 Group (LSE:TM17) | £550m | Development Studio | Indie video game development studio with various titles under its belt. |

| Frontier Developments (LSE:FDEV) | £530m | Development Studio, Publishing House | It develops and publishes video games for personal computers and video game consoles and publishes smaller indie titles. |

Top Gaming Stocks in the US by Market Capitalisation

| Company | Market Cap. | Category | Description |

|---|---|---|---|

| Activision Blizzard (NASDAQ:ATVI) | $60.4bn | Development Studio | Develops and publishes interactive entertainment content and services |

| Electronic Arts (NASDAQ:EA) | $31.5bn | Development Studio, Publishing House | It develops, markets, publishes and distributes games, content, and services for game consoles, PCs, mobile phones, and tablets worldwide |

| Roblox (NYSE:RBLX) | $16.5bn | Development Studio | It develops and operates an online entertainment platform. |

| Take-Two Interactive Software Inc (NASDAQ:TTWO) | $12.3bn | Development Studio, Publishing House | It develops, publishes, and markets interactive entertainment solutions. |

Should I Invest in Gaming Shares?

Undoubtedly, investing in gaming stocks offers a great opportunity for high-return investments for those willing to take on some extra risk. At least, that’s what I think. And it seems legendary investor, Warren Buffett would agree with his latest move to buy a large stake in Activision Blizzard.

With games becoming ever more immersive experiences, the demand for this form of media entertainment is rising and is expected to continue climbing for many years to come.

Personally, I believe investing in gaming stocks exposes my portfolio to some fantastic opportunities to be found in this space. But I’ll be taking a diversified approach to spread my bets as not every company will end up delivering solid performance.

Discover market-beating stock ideas today. Join our Premium investing service to get instant access to analyst opinions, in-depth research, our Moonshot Opportunities, and more. Learn More

Saima Naveed does not own shares in any of the companies mentioned. The Money Cog has published Premium reports on Keywords Studios and Frontier Developments. Views expressed on the companies and assets mentioned in this article are those of the writer and therefore may differ from the opinions of analysts in The Money Cog Premium services.