Rolls Royce (LSE:RR) is a premium luxury car manufacturer which started operations way back in 1904. Today, it is a major player in the aviation industry. But the company’s glory days ended when the pandemic hit.

The Rolls Royce share price was slashed by more than 50% when Covid-19 reached pandemic status. However, the company’s stock has found its path towards recovery. Since the last quarter of 2022, the stock has been escalating high. In the year 2023 alone, the stock has risen by 63.25%. It sure looks like one of the UK’s best blue-chip value stocks.

Will this accelerated growth continue? Or are there roadblocks ahead?

Let’s find out.

New Growth. New Future

The news of the company reviving its dividend has gotten investors all pumped up. Rolls Royce cancelled its dividend in 2019. However, it has planned to revive it from the year 2023 with a projected 1.63p per share dividend. While this is not extraordinary and nothing near the market average, the hype it has created is enough to bring back the investors.

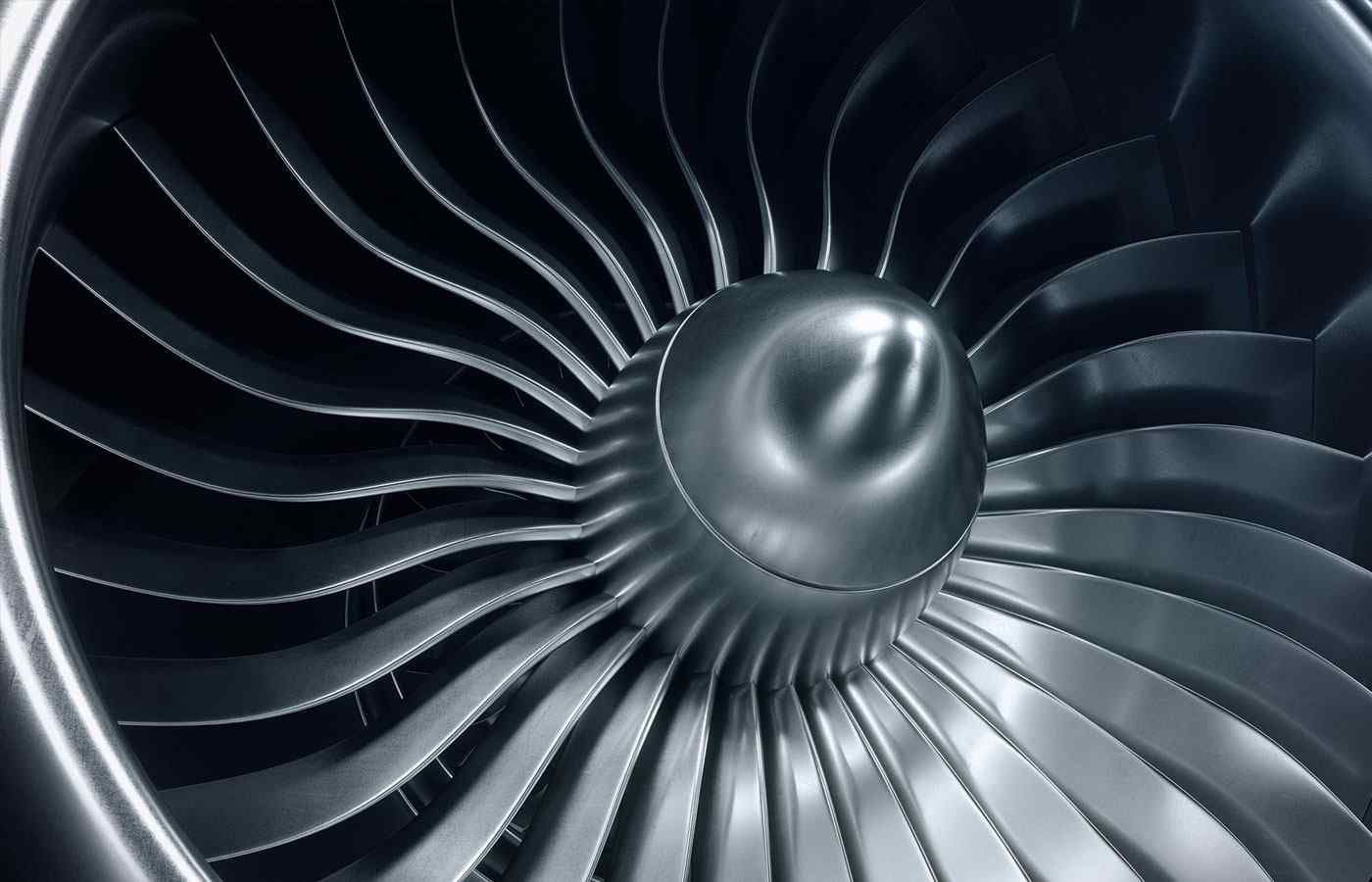

Also, the increase in passengers for air travel brings a positive outlook for airlines and aerospace companies. The company is also largely dependent on a healthy civil aviation market. A huge chunk of revenue is generated via building and servicing plane engines.

Looking at the company’s financials, the revenues are surely rising. But the huge financial cost is casting a dark cloud over its financial position. Net debt was reported to be £3.3bn as of the end of 2022. If things go bleak, the company would struggle a lot to repay its debt.

Investor confidence

I think it’s fair to say that investor confidence is still shaken. No doubt the recovery signs are all there, and several critical steps have been taken to ensure its survival. The revenues are expected to grow by double-digit in the next couple of years, making the future outlook positive for Rolls Royce.

While the company is certainly not out of the woods yet, I find the latest actions taken by the management team encouraging. And providing nothing else goes wrong, then I believe investor confidence and the Rolls Royce share price will return to its glory days.

The Rolls Royce share price journey

Currently, the Rolls Royce share is trading at around 152.15p. The stock remained bearish through the major part of 2022 and dropped to the low of 69.59p. From here on, the Rolls Royce stock picked up momentum and appreciated by 118% from the lowest low.

Rolls-Royce shares soared after the company’s annual results sharply beat expectations. This growth was attributed to the recovering demand for air travel.

What’s next for the Rolls Royce share price?

Looking ahead, the company is confident it can build on last year’s impressive performance. The operating profit forecast is £0.8bn-£1bn, compared to £0.65bn in 2022. In addition, the business expects to generate £0.6bn-£0.8bn in free cash flow, up from £0.51bn last year1.

In addition to it, the luxury car manufacturer is undergoing a transformation program to improve its performance in 2023 which will be led by a strategic review. The are undoubtedly plenty of challenges for the company to overcome in the next few years. But if Rolls Royce can make it through and raise enough capital to restructure its balance sheet, then it may have a lucrative future ahead of it. But, for now, I’m keeping it on my watch list.

Discover market-beating stock ideas today. Join our Premium investing service to get instant access to analyst opinions, in-depth research, our Moonshot Opportunities, and more. Learn More

Article sources

Saima Naveed does not own shares in any of the companies mentioned. The Money Cog has no position in any of the companies mentioned. Views expressed on the companies and assets mentioned in this article are those of the writer and therefore may differ from the opinions of analysts in The Money Cog Premium services.