The BT Group (LSE:BT.A) share price is down by about 53% in the last five years. And last year, it reached its lowest point since the 2008 financial crisis. However, it seems the tides are changing because the BT share price is up more than 60% in a year. Most of this growth has been achieved in 2021, as the effects of the pandemic begin to wear off. But can the stock continue to climb from here? And should I be adding this business to my portfolio? Let’s take a look.

Company background

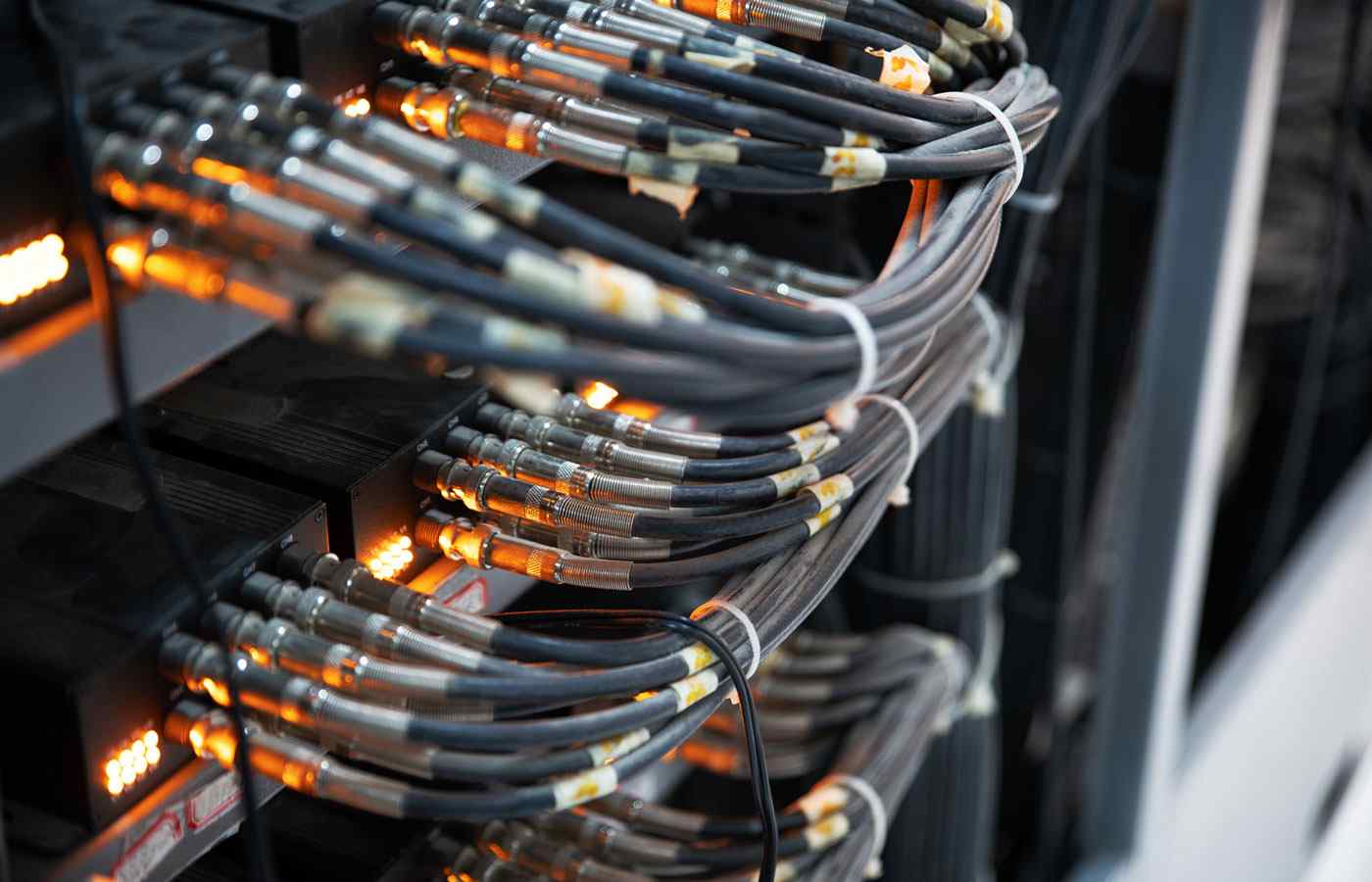

BT is the largest telecommunications company in the United Kingdom and operates in over 180 countries worldwide. The company has multiple divisions, namely its Consumer, Enterprise, Global and Openreach segments. The firm provides a long list of products and services, including business telecommunication solutions, internet connectivity networks, and mobile communication technology, among other offerings as well.

After years of development and expansion, BT has become an industry leader. Today many of its competitors are paying to use the firm’s infrastructure to provide their own services to customers. This not only further diversifies its revenue base but also generates substantial pricing power. In my experience, these are excellent traits to have, so I do see the potential for the BT share price to continue to climb. But let go further into the details.

Innovation: A catalyst for the BT share price.

Having invested £2.5 billion in research & development (R&D) in the last five years, BT has come in third place in the race for highest research investments within the UK public market. While R&D doesn’t always lead to profitable discoveries, it has enabled many businesses to find new ways to evolve and improve. BT is no exception, and it’s through these expenses, the company is now rolling out the UK’s 5G network.

Combining this latest generation of communications technology with its continued expansion of internet fibre-to-the-premises (FTTP) has created a new source of growth for the business. This is undoubtedly excellent news for the BT share price.

Beyond the deployment of new technology, the management team is also starting to remove its legacy products. The list includes its 3G network that is planned to be disposed of by 2023. Around 2% of the firm’s customers still use this legacy network. And so, the plan is to migrate them onto the more modern 4G and 5G technology by 2023. Given these products tend to be relatively low margin, I see this move as a prudent one to help trim the fat from the company.

The risks that lie ahead for the BT share price

The progress made in recent months is quite encouraging. At least, I think so, especially since this business has been idle for too long. That’s why the BT share price has been falling for the past couple of years.

But as encouraging as this latest performance has been, there remain several risks that give me pause. Building and running a massive telecommunications network is not a cheap endeavour. And as a consequence, the business has racked up a notable amount of debt. Today, the company has around £22.8bn of loans on its balance sheet. By comparison, its market capitalisation is only £18.4bn. Needless to say, it’s a highly leveraged business.

The firm has also been having a bit of trouble with the Communications Workers Union (CWU). In a recent update, the management team finally announced some “constructive negotiations” were underway. In my experience, a company with a happy workforce tends to fare much better off in the long run, so this is a promising sign. But should these negotiations fail to be resolved agreeably for both parties, the BT share price could take a big hit.

The bottom line

All things considered, I believe the BT share price is capable of climbing higher, especially with the rollout of 5G only just now ramping up. Having said that, I’d like to know a bit more about the progress being made with its latest developments. And so, I’m keeping BT on my watchlist until the next earnings report is released in October.

Discover market-beating stock ideas today. Join our Premium investing service to get instant access to analyst opinions, in-depth research, our Moonshot Opportunities, and more. Learn More

Prosper Ambaka does not own shares in any of the companies mentioned. The Money Cog has no position in any of the companies mentioned. Views expressed on the companies and assets mentioned in this article are those of the writer and therefore may differ from the opinions of analysts in The Money Cog Premium services.