Special Purpose Acquisition Companies, or SPACs, have been around since 1993. But they became all the market rage in 2020 and were responsible for raising over $83bn during the year1. In fact, for the first time in history in the United States, the number of SPAC IPOs was higher than traditional IPOs jumping from 59 in 2019 to 248 in 2020, to 613 in 20212!

But what exactly are these investment vehicles? How do they work? And should investors be considering them for their portfolios? Let’s take a closer look.

What is a Special Purpose Acquisition Company?

A SPAC is a development stage company. These are shell corporations designed to merge with a private company and take it public. Therefore, they are an alternative to the traditional Initial Public Offering (IPO) approach. And generally speaking, going public with this alternative route is cheaper, faster, and less complicated from a regulatory perspective.

When a SPAC is created and listed on a stock exchange, usually, a target private company has already been selected by the manager, known as a SPAC Sponsor.

However, this information is rarely disclosed, creating a lack of transparency. And even in the cases when it is, there’s no guarantee the deal will be successful. After all, a private company may not be interested. Consequently, investors buying shares in a SPAC usually don’t know what they’ll end up with. That’s why these firms are often described as blank cheque companies.

How does a Special purpose acquisition company work?

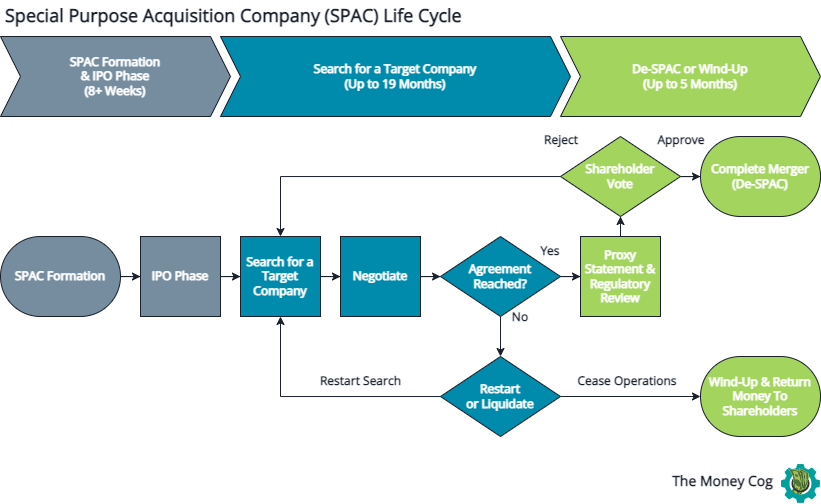

There are a lot of steps involved in the formation, search, merger, and regulatory process for a SPAC. However, these can be categorised into four primary stages.

1. SPAC Formation

The managers who establish and run the shell company are known as the sponsors. Sponsors are typically well-funded, well-known individuals, private equity firms or venture capitalists.

Investors don’t know what they’ll end up owing. Therefore, the sponsors need to have a strong reputation and demonstrated expertise to attract investment in the SPAC. Depending on the amount of money raised, the company may be limited in which private enterprises it can target.

2. IPO Phase

Once established, the SPAC makes its debut on a stock exchange such as the London Stock Exchange or New York Stock Exchange. This is done through the traditional IPO process. However, since it’s just a shell company, there are minimal paperwork and regulatory requirements to meet. After all, there aren’t typically any assets beyond just cash or short-term investments to disclose.

Once complete, the SPAC is assigned a ticker symbol, and shares are floated at a standard price of $10. The money raised through the initial public offering is placed into an escrow account. And the sponsors can now begin their hunt for a private company.

3. Search for a Target Company

Sponsors are on the clock. SPACs legally have only 24 months to identify a private business and complete the merger process.

Usually, sponsors already have a target in mind and will reach out to begin negotiations quickly. But if talks fail, the sponsor will have to start from scratch.

4. De-SPAC or Wind-Up

Once the target company is identified and an agreement is reached, the sponsors publicly announce it. Shareholders within the SPAC will now have the opportunity to share their opinion with a vote. If shareholders vote in favour, a reverse merger is executed where the private company becomes the SPAC, taking its listing on the stock exchange. This is known as a De-SPAC.

Sometimes, a special purpose acquisition company may not have raised enough money from its IPO to afford a negotiated deal. In this case, sponsors may issue new shares to the public to try and raise the missing funds.

However, should shareholders reject the proposed deal, sponsors will once again have to restart the search for a different target company. But, sometimes SPACs aren’t successful in their search. And if time runs out, then SPAC must begin the Wind-Up process. The firm is liquidated, with all cash assets returned to shareholders.

SPAC IPO vs traditional IPO

In a traditional IPO, a private business hires an underwriter (usually an investment bank) to go public and issue shares on a stock exchange. However, by going public via SPAC, most of this process can be skipped saving time and money.

Some of the biggest differences between a SPAC vs an IPO include the following:

- Speed – Once SPAC shareholders sign and approve an agreement, a company can go public within five months. By comparison, this process can take up to 12 to 18 months with a traditional IPO.

- Pricing – Private can negotiate better share pricing when engaging with a SPAC. In a traditional IPO, pricing is highly dependent on market conditions.

- Timing – SPAC sponsors are on the clock, and negotiations, along with regulatory submissions, need to be made quickly. This means private companies have less time to prepare financial statements and other required documents compared to a traditional IPO.

- Underwriter – Since the private company is merging with an existing shell company that is already listed, there is no need to hire an underwriter, reducing costs significantly.

Advantages of going public via SPAC

As previously highlighted, a Special Purpose Acquisition company offers quite a few benefits over the traditional route of an IPO. However, they also provide additional benefits to both the sponsors and investors in general.

- Faster & Cheaper – Going public via SPAC doesn’t require an investor roadshow or underwriter. Furthermore, there are far lower levels of regulatory requirements to satisfy. As a result, the cost of going public with this alternative route is significantly lower than a traditional IPO. Additionally, it only takes a fraction of the time.

- New Deals – Sponsors can leverage their expertise, experience, and connections to complete deals that may not have been possible with traditional IPOs.

- Semi-Protected Investment – For investors, even if a SPAC is unsuccessful, their investment is protected by regulators. If one of these firms fails to find an acquisition target, shareholder capital is returned. However, the amount returned equals $10 per share – the original issue price. If investors paid more than $10 for shares in a SPAC in anticipation of a deal being signed, the liquidation of a SPAC would result in an investment loss.

Disadvantages of a Special Purpose Acquisition Company

As advantageous as this approach to going public seems, investors must consider some significant drawbacks.

- No Transparency – By their very nature, SPACs are shrouded in mystery. Investors rarely know what private company they will own, if any. And even if a target is announced and sounds promising, if most other shareholders aren’t happy with the deal, it won’t go through.

- Reduced Regulatory Oversight – Companies skipping the intense level of due diligence required in a traditional IPO can save a lot of money. However, for investors, it can create problems and is known to be a cause of fraudulent and misrepresented financial statements.

- No Deal Guaranteed – Most SPACs fail to find a target company to merge with. And even if the sponsors and the business reach an agreement, it could all go up in flames if shareholders reject the offer.

- Risk of a Bad Deal – Sponsors may be looking for a lucrative exit when time runs short. After all, they only get paid if a deal is signed and approved. Therefore, it’s not uncommon for an agreement to be reached with a mediocre private company dressed up to be superior than it actually is. Misled shareholders could approve a deal that results in them owning a lacklustre business that fails to deliver positive investment returns.

How to buy SPAC shares?

Shares of a SPAC are traded just like any other common stock. Investors can buy and sell shares through their investment account provided they can access the stock exchange on which the SPAC is listed. Alternatively, investors can opt to buy a collection of SPAC shares through an exchange-traded fund (ETF).

Which companies have gone public via SPAC?

The table below outlines the ten largest US private companies to go public via SPAC as of 1 April 2023.

| Rank | Name | Ticker | Market Cap | Industry | De-SPAC Date |

|---|---|---|---|---|---|

| 1 | Lucid Group | LCID | $13.95bn | Automotive | 09/18/2020 |

| 2 | Grab Holdings Ltd | GRAB | $10.94bn | Financials | 12/01/2020 |

| 3 | Willscot Corp. | WSC | $9.53bn | Industrials | 11/30/2017 |

| 4 | DraftKings Inc | DKNG | $8.73bn | Consumer Discretionary | 07/25/2019 |

| 5 | Clarivate | CLVT | $6.26bn | Technology | 10/29/2018 |

| 6 | Roivant Sciences Ltd | ROIV | $5.54bn | Healthcare | 12/08/2020 |

| 7 | SoFi Technologies Inc | SOFI | $5.35bn | Financials | 11/30/2020 |

| 8 | Vertiv Holdings Co | VRT | $5.21bn | Electrical Equipment | 07/30/2018 |

| 9 | Mp Materials Corp | MP | $4.91bn | Metals & Mining | 06/22/2020 |

| 10 | Paysafe Ltd | PSFE | $987.82m | Financials | 10/09/2020 |

The bottom line

Special purpose acquisition companies serve an important role in the modern marketplace enabling private businesses an alternative way to become public. However, while having a shortcut is advantageous, it also exposes investors to additional risk, especially regarding the lack of transparency.

Despite these factors, SPACs have gained immense popularity in recent years, with many retail investors looking for brand-new investing opportunities.

Article sources

- Bloomberg. “SPACs were hot in 2020 and are hotter now. Here’s why“

- SPAC Insider. “SPAC Statistics“

Discover market-beating stock ideas today. Join our Premium investing service to get instant access to analyst opinions, in-depth research, our Moonshot Opportunities, and more. Learn More

This article contains general educational information only. It does not take into account the personal financial situation of the reader. Tax treatment is dependent on individual circumstances that may change in the future, and this article does not constitute any form of tax advice. Before committing to any investment decision, an investor must consider their individual financial circumstances and reach out to an independent financial adviser if necessary.