Investing in oil stocks and shares in recent months has been quite lucrative. Despite the pandemic pushing prices into negative territory, the trend has now reversed, and the industry is now on fire. In fact, the overall sector growth has beaten all expectations, and oil prices haven’t been this high since 2014!

There will always be fluctuations in oil prices, and this does add a degree of uncertainty to an already complex industry. But let’s break down the details and explore the key details investors need to know, what the forecasts predict for the long-term future of oil shares, and which factors are important to watch.

What are Oil stocks?

The energy sector is among the world’s largest industries. In fact, this stock market sector holds a significant percentage of the world’s GDP. What’s more, it’s worth mentioning that the world’s largest producers are the United States, Saudi Arabia, and Russia.

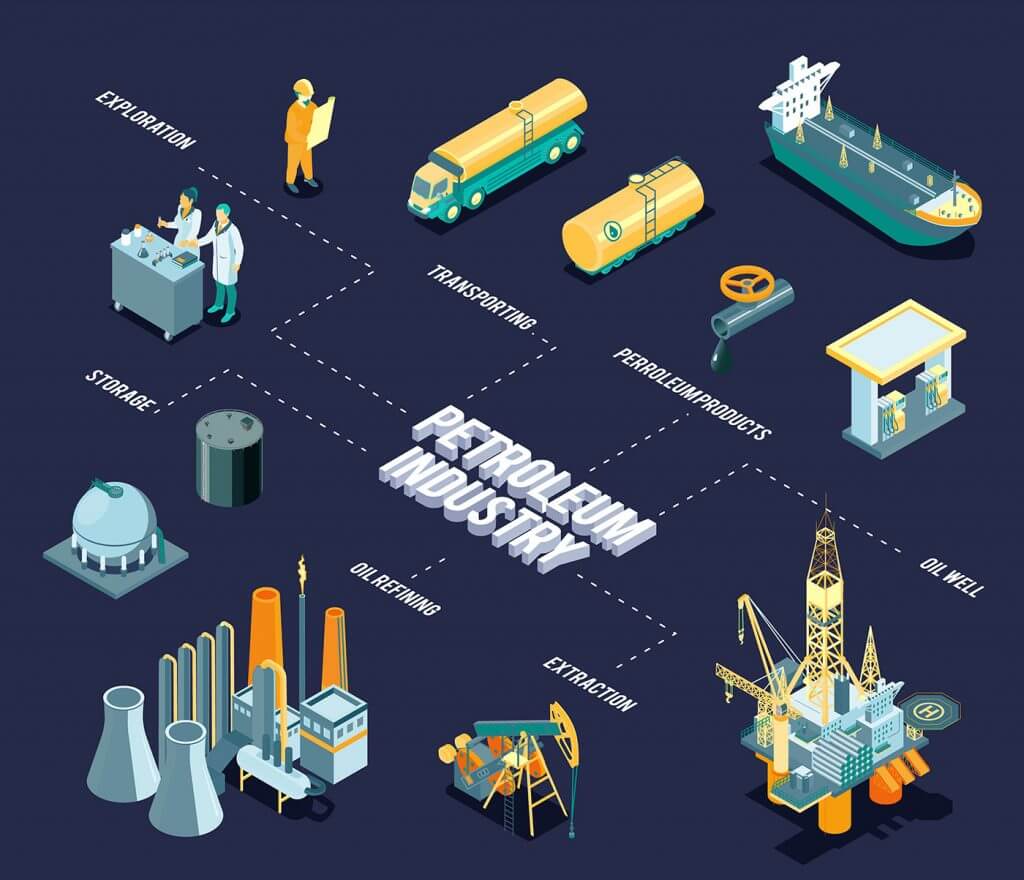

Yet often, two companies are not comparable because there are lots of different kinds of oil businesses with different corporate structures. Let’s explore the most common:

- Upstream – These are arguably the most common type of energy stocks and are the most susceptible to fluctuating prices. They engage in the exploration and production around the world both on- and off-shore. The largest Upstream oil business in the US is ConocoPhillips.

- Midstream – The companies involved with the logistics of transporting, processing, and storing oil & gas products. Since they typically make their money on long-term fixed-rate contracts, these types of businesses aren’t affected by fluctuating oil prices. An example of such a business from the UK would be SSE.

- Downstream – Any business that takes oil & gas and turns it into a usable refined product as gasoline or petrochemicals falls under this category. Like Upstream stocks, Downstream businesses are also susceptible to fluctuating oil prices as well as fuel demand. So, when 2020 lockdowns came along, and people weren’t using their cars for several weeks, the profits of these companies virtually disappeared overnight.

- Integrated – The “Big Oil” companies fall into this category. Simply put, this segment contains any business that has Upstream, Midstream, and Downstream operations combined. This is where investors will find oil stocks like BP, Exxon Mobil, Shell, and Chevron.

- Oilfield Services – This is the last, often forgotten, major category. And as the name suggests, any business that provides equipment, support, and other services to Upstream businesses during both the exploration and extraction phase. While the group is not directly exposed to fluctuating oil prices, if prices start to fall, then demand for their services typically follows suit.

In terms of corporate structure, shares can fall into one of three categories:

- Nationalised – These are the companies that are partly or wholly owned by the state of their respective countries and rarely have operations outside of their nation. Some examples include Saudi Aramco, Sonatrach, and Nigerian National Petroleum Corporation (NNPC).

- Unnationalised – More common type of business that operates in different countries typically without any state ownership. Examples include Shell, Exxon Mobil, and TotalEnergies.

- Independent – Typically private corporations with small operations serving a particular segment of the oil and gas industry.

The Risks and Challenges Faced by Oil Shares

Every industry is prone to sector-specific threats and hurdles. Hence, managing the risks and handling the challenges is essential for a company to become an industry leader. Let’s explore some of the most common difficulties oil stocks are facing today.

- Reducing Costs and Emissions – The global population continues to increase. And with it, the demand for fossil fuels, especially from developing nations. However, as the impact of global warming is becoming ever more apparent, activists and governments alike are pushing for oil shares to lower their carbon footprint. That’s not exactly easy. And yet it needs to be done if these companies want to survive in a net-zero emission world with a current deadline of 2050.

- Continuous Investment – In the long-term, fossil fuels may no longer be a primary energy resource. But over the next several decades, demand will undoubtedly continue. But with oil & gas being a finite resource and geopolitical tensions making it difficult to access, companies have to ramp up their exploration efforts, much to the dismay of environmentalists. And raising capital for such purposes will undoubtedly become more challenging over time.

- Generating Reliable Cash Flows – While prices are high, these companies tend to have no issue paying down debts, buying back shares, and issuing dividends. But since this is a cyclical industry, there are periods when prices plummet. And it’s not uncommon to see younger companies go under as a consequence.

- Exploratory Failure – For younger oil stocks, a lot of capital can be invested into a promising prospective drilling site. Yet there are countless examples where early data was promising, but when drilling began, the well was discovered to be of poor quality or not economically viable to extract. This can be a death sentence for some companies.

- Supply Chain Disruption – Like any business, maintaining the supply chain is an essential piece of the puzzle and can lead to disastrous consequences if a link is cut. Just recently, the UK suffered through a fuel shortage since no drivers were available to transport the fuel from the ports to the stations. Meanwhile, countries like Germany are struggling to maintain their access to oil & gas after ties with Russian oil were cut.

Key Financial Metrics to Check Before Investing in Oil Stocks

The oil industry is capital intensive. That’s most of these businesses have substantial debt piles. Used correctly, it can be a powerful tool for growth. But if it’s mismanaged, then it can land oil stocks into a world of trouble. With that said, here are some of the most important financial metrics I look out for when analysing these types of businesses.

- Debt-to-EBITDA, Debt-to-Capital, Debt-to-Equity – Demonstrates the degree of leverage a company has. A high value indicates the company might be overburdened and deserves further investigation.

- Interest Coverage Ratio – The ability of a company to pay the interest on its outstanding loans.

- Enterprise Value/Barrels of Oil Equivalent per Day – Comparing the enterprise value of oil shares to their level of production can serve as a useful indicator when judging if the stock price is over or undervalued.

- Price/Cash Flow per Share – This financial metric is excellent for investors who are thinking of investing in oil shares. Since cash flow cannot be manipulated, this ratio is excellent for comparison among different companies.

- Enterprise Value/Debt-Adjusted Cash Flow – This financial metric is a measure of a company’s total value. In fact, it is often used as a more comprehensive alternative to equity market capitalisation.

Key Terms when Investing in Oil Stocks

Before investing in oil stocks, it is very important to understand the language of the industry. After all, there is a lot of jargon that’s often not explained. Let’s take a look.

- Arbitrage – The buying, selling, and exchange of petroleum products or crude oil in different markets with the express design to take advantage of location, product, and timing differentials.

- Atmospheric Crude Oil Distillation – The refining process of separating crude oil components at atmospheric pressure by heating to temperatures of about 600 degrees Fahrenheit to 750 degrees Fahrenheit.

- Basis – The difference between the price of the oil and the price of the futures contract.

- Benzene (C6H6) – An aromatic hydrocarbon presents in small proportion in some crude oils.

- BOED – Barrels of oil equivalent per day.

- BPD – Barrels per day.

- BTU– British thermal unit. It is a measure of heat energy.

- Bunker Fuel -A heavier residual fuel oil used in a ship’s boilers.

- Coker – An oil refining unit.

- Crude Distillation Unit – A refinery unit that separates crude oil into different products according to their boiling point ranges.

- E & P – Exploration & Production.

- MWD – Measuring While Drilling. This is used in directional drilling.

- Residual Fuel Oil – A general classification for heavier oils.

- ROP – Rate of penetration. This is the rate at which drilling is done.

- TD – Total Depth of the well

- Turnkey – A financing agreement where the contractor receives a lump-sum payment upon supplying a well of a given specification/depth to the operator

Market size and Forecasted Growth of the Oil Industry

The oil industry is currently experiencing a mega transformation. According to a survey conducted by Deloitte, the oil companies’ new focus is on:

- Streamlining and optimising resource portfolios.

- Embracing and developing smart goals for the energy transition.

- Employee retention and attracting the right labour in the currently tight market

- Coming to terms with additional environmental, social, and governance (ESG) requirements.

Total revenues for the oil & gas drilling sector in 2021 came to approximately $2.1trn, according to a report issued by Benchmark International. As per the report, the market size is forecast to hit $7.43trn by 2025, growing at a compounded annual rate of 6%.

This rising demand can be attributed to two primary factors:

- Europe and Asia shifted from gas to oil. Since gas prices are extremely high on these continents, making the latter a cost-friendly option

- Rise in Airborne freight to combat the global supply chain issues

As such, in 2022 alone, oil demand is forecast to reach 100.2 million barrels per day. And According to the International Energy Agency, global stores were reduced by 600 million barrels in 2021. This represents a 200-million-barrel difference from the forecasted amount. As a result of this shortfall, the year 2022 will see a tight supply in the industry.

Top Oil Stocks in the UK by Market Capitalisation

Let’s explore the five biggest oil companies listed on the London Stock Exchange in the United Kingdom.

| Company | Market Cap. | Category | Description |

|---|---|---|---|

| Shell (LSE:SHEL) | £176bn | Integrated | It operates as an energy and petrochemical company in Europe, Asia, Oceania, Africa, the United States, and the Rest of the Americas. |

| BP (LSE:BP) | £101bn | Integrated | It engages in the energy business worldwide. It operates through Gas & Low Carbon Energy, Oil Production & Operations, Customers & Products, and Rosneft segments. |

| Harbour Energy (LSE:HBR) | £4.3bn | Upstream | It is an independent oil and gas company that engages in the acquisition, exploration, development, and production of oil and gas reserves. |

| Energean (LSE:ENOG) | £2.45bn | Upstream | It engages in the exploration, development, and production of oil and gas. |

| Tullow Oil (LSE:TLW) | £797.3m | Upstream | It engages in the oil and gas exploration, development, and production activities primarily in Africa and South America. |

Top Oil Stocks in the US by Market Capitalisation

Below are the five largest oil companies listed in North America.

| Company | Market Cap | Category | Description |

|---|---|---|---|

| Exxon Mobil (NYSE:XOM) | $384bn | Integrated | This oil company explores for and produces crude oil and natural gas in the United States and internationally. |

| Chevron Corp (NYSE:CVX) | $339.93bn | Integrated | It engages in integrated energy and chemicals operations worldwide. |

| ConocoPhillips (NYSE:COP) | $136.4bn | Upstream | It explores for, produces, transports, and markets crude oil, bitumen, natural gas, liquefied natural gas (LNG), and natural gas liquids worldwide. |

| Pioneer Natural Resources Co (NYSE:PXD) | $65bn | Upstream | It operates as an independent oil and gas exploration and production company in the United States. The company explores for, develops, and produces oil, natural gas liquids (NGLs), and gas. |

| Occidental Petroleum Corp (NYSE:OXY) | $63.5bn | Upstream | It engages in the acquisition, exploration, and development of oil and gas properties in the United States, the Middle East, Africa, and Latin America. |

Should I buy Oil Shares?

Without a doubt, the oil industry is highly competitive and volatile. As a result, profits can be deeply affected by small changes in supply and demand. Therefore, investing in oil stocks is not suitable for every investor and carries a lot of investment risk.

Having said that, I personally believe the post-Covid era will elevate shares of oil companies to new heights, even with ongoing supply chain disruptions. While demand for these products may eventually disappear as renewable energy sources become more reliable and cheaper, I believe these stocks could be a fine candidate for my portfolio.

Discover market-beating stock ideas today. Join our Premium investing service to get instant access to analyst opinions, in-depth research, our Moonshot Opportunities, and more. Learn More

Saima Naveed does not own shares in any of the companies mentioned. The Money Cog does not have a position in any of the companies mentioned at the time of publishing. Views expressed on the companies and assets mentioned in this article are those of the writer and therefore may differ from the opinions of analysts in The Money Cog Premium services.