Investing in defence stocks and shares has a reputation of being a safe move amongst investors. And it’s not hard to see why. With the US government and others just like it constantly seeking better equipment, arms, and defence systems, the demand for such products is not exactly in short supply. And with military budgets currently on the rise courtesy of the tragic geopolitical tensions in Eastern Europe, this stock market sector seems to be thriving.

With that in mind, let’s dive deeper into this industry and explore the risks and potential returns for my portfolio.

What Are Defence Stocks?

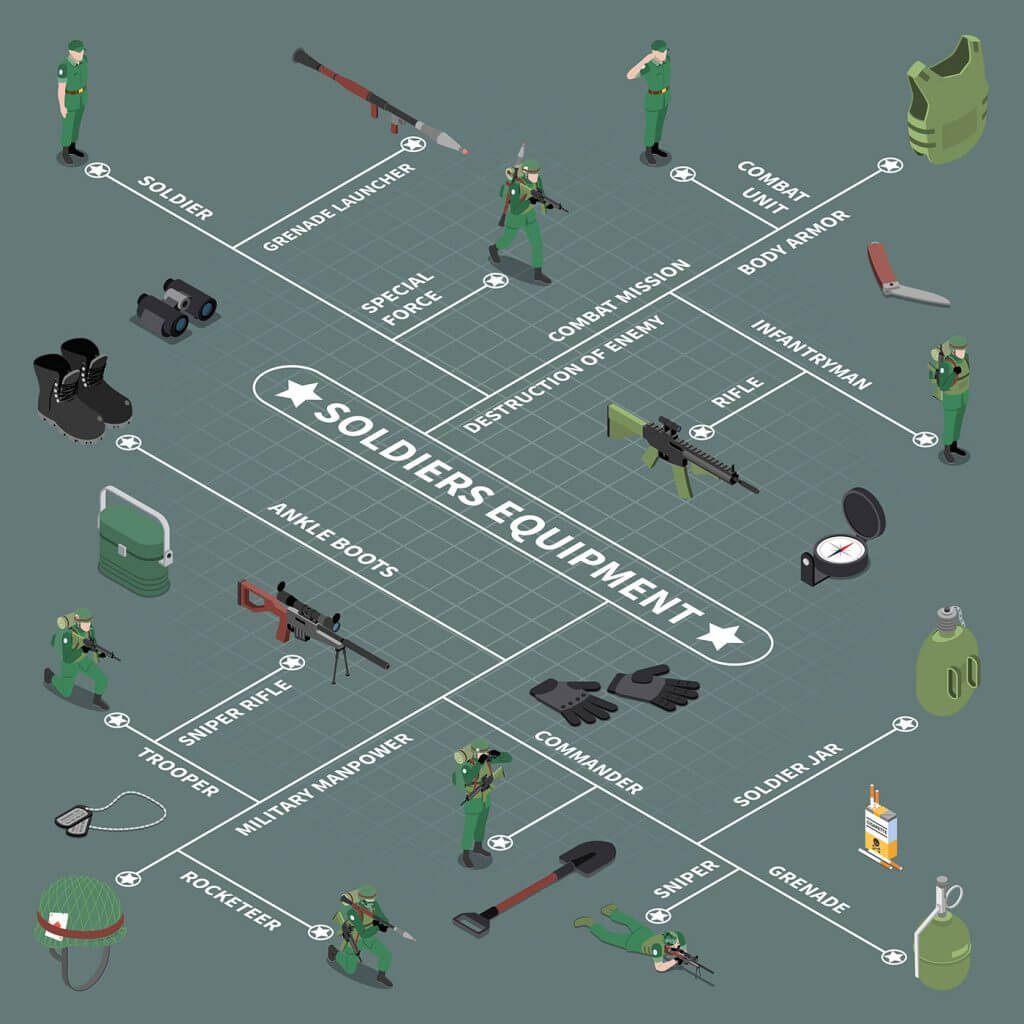

Defence stocks simply refer to the shares of the companies providing some form of security product or service to law enforcement departments like the police or to the military. The sector spans much further from the typically envisioned gun manufacturer or defence equipment provider. While this is undoubtedly a core part of the industry, it also captures intelligence gathering and training services.

The hike in global tension due to Russia and Ukraine coupled with China disputing boundaries has created a significant amount of geopolitical instability. While this is generally bad news for most, it does boost demand for the products and services offered by defence stocks and shares.

Generally, defence companies have four target markets:

- Navy – All the companies involved in sea control, power projection, deterrence, maritime security, and sea lifts.

- Airforce – The firms engaged in transportation and logistics, maritime surveillance, search & rescue, disaster relief, peacekeeping, civil assistance, and antarctic support fall under this category.

- Defence Logistics – These businesses manage the end-to-end global defence supply chain for the military.

- Army – This is the largest military division that offers its services to protect the country and the citizens.

The Risks and Challenges Faced by Defence Shares

Since most revenue comes from the federal government, these companies often have a fairly stable source of recurring income. And is largely the reason why investors regard investing in defence stocks and shares as “safe”. However, the sector deals with matters of national security. And that’s far from a risk-free endeavour.

That’s why I don’t think investing in this space should be treated lightly. Let’s take a look at some of the most prominent threats these companies are currently having to contend with:

- The Rise of AI – AI is increasingly becoming an important tool in the modern era. But within the military sector, the biggest challenge is about procuring, developing, and fielding AI solutions the fastest. Not to mention finding ways of defending military systems from AI-powered cyber attacks.

- Weapon Testing – A recent big project the US military is working on is hypersonic weaponry. But this project requires long-range test corridors, which are currently unavailable. Therefore, the military is at risk of delaying the project, which could mean losing the weapon race versus other superpowers.

- Environmental Impact – Needless to say, war is not good for the environment. And with global warming becoming an ever more present threat, the impact of military operations is now being considered as a consequence.

- Social Media – People are still unaware that seemingly innocuous social media activity coming from any of the military personnel can put the military at risk. Hence, not only cyber security needs to be attended but educating military personnel about the risks is equally important.

Key Financial Metrics To Consider Before Investing In Defence Stocks

It’s very important to pay attention to the key financial metrics before investing in any stock market sector, and defence shares are no exception. In my experience, there are three primary financial statistics that I like to follow when analysing companies in this space:

- Allocated Budget – How much the government is allocating to the defence sector has a direct impact on the revenues and profitability of defence stocks.

- Free Cash Flow – This is an important financial metric to identify whether the company has new or well-established operational projects.

- Book-to-Bill Ratio – Book to bill ratio is an excellent indicator of the defence stocks’ growth potential. It tells whether the orders are booked and being shipped at what rate.

Key Terms To Know Before Investing In Defence Stocks

Indeed, the defence industry has its unique language like every other sector. But these terms are seldom explained despite their high degree of importance. With that said, let’s go through some of the most common phrases of jargon.

- AMF – Allied Mobile Force

- APC – Armored Personnel Carrier

- AWACS – Airborne Warning And Control Systems

- CGS – Chief of General Staff

- C Sups – Combat Supplies

- CV – Combat Vehicle

- GDP – General Defence Plan

- EW – Electronic Warfare

- L of C – Lines of Communication

- MOD – Ministry of Defence

- NAAFI – Navy Army and Air Force Institutes

- RAF – Royal Air Force

- POW – Prisoner of War

Market Size and Forecasted Growth of the Defence Sector

According to a report by Research and Markets, the US’s defence expenditure recorded a compounded annual growth of 3.8% between 2017 and 2021. At the end of this period, the total budget stood at an impressive $703.7bn, with a large chunk spent on improving military readiness through digitalisation and modernisation.

Moving forward, military spending in the US alone is expected to continue growing by 2% annually, reaching $773.3bn by 2026.

After the United States, the UK is the world’s second-largest defence exporter, with forecasts estimating a similar growth rate as across the pond. And as the government recently announced a €238bn ($270bn) investment plan between now and 2031, the market opportunity seems to be expanding drastically.

Top Defence Stocks In The UK By Market Capitalisation

| Company | Market Cap. | Description |

|---|---|---|

| BAE Systems (LSE:BA) | £24.6bn | BAE Systems plc provides defence, aerospace, and security solutions worldwide. The company operates through five segments: Electronic Systems, Cyber & Intelligence, Platforms & Services (US), Air, and Maritime. |

| Ultra Electronics (LSE:ULE) | £2.31bn | Ultra-Electronics Holdings plc provides application-engineered bespoke solutions in the defence, security, critical detection, and control markets. The company operates through three segments: Maritime, Intelligence & Communications, and Critical Detection & Control |

| QinetiQ (LSE:QQ) | £2.13bn | QinetiQ Group plc operates as a science and engineering company primarily in the defence, security, and infrastructure markets in the United Kingdom and internationally. |

| Avon Protection (LSE:AVON) | £333m | Avon Protection designs, manufactures, and sells chemical, biological, radiological, and nuclear respiratory protection systems for military, law enforcement, and fire markets worldwide. |

Top Defence Stocks In The US By Market Capitalisation

| Company | Market Cap. | Description |

|---|---|---|

| Raytheon Technologies (NYSE:RTX) | $143.3bn | Raytheon Technologies Corporation, an aerospace and defence company, provides systems and services for commercial, military, and government customers worldwide. |

| Honeywell (NASDAQ:HON) | $132.6bn | Honeywell International Inc. operates as a diversified technology and manufacturing company worldwide. |

| Lockheed Martin (NYSE:LMT) | $117.8bn | Lockheed Martin Corporation is a security and aerospace company that engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide. |

| Northrop Grumman (NYSE:NOC) | $74.4bn | Northrop Grumman Corporation operates as an aerospace and defence company worldwide. The company’s Aeronautics Systems segment designs, develops, manufactures, integrates, and sustains aircraft systems. |

| General Dynamics (NYSE:GD) | $63.9bn | General Dynamics Corporation operates as an aerospace and defence company worldwide. It operates through four segments: Aerospace, Marine Systems, Combat Systems, and Technologies. |

Should I Invest In Defence Shares?

The defence budget is at an all-time high. And the future sees no reduction in this amount, as well as forecasts predict increased defence spending throughout the next decade. That’s certainly a characteristic I like to see when investigating a stock market sector for potential investments.

Personally, I believe there are some fantastic opportunities in this space for my portfolio today. However, I also realise there are significant risks that might make this industry unsuitable for other investors.

Discover market-beating stock ideas today. Join our Premium investing service to get instant access to analyst opinions, in-depth research, our Moonshot Opportunities, and more. Learn More

Saima Naveed does not own shares in any of the companies mentioned. The Money Cog does not own any shares in the companies mentioned. Views expressed on the companies and assets mentioned in this article are those of the writer and therefore may differ from the opinions of analysts in The Money Cog Premium services.